In short, the best cryptocurrency brokers in the UK for 2025 are Avatrade, BlackBull Markets, and Exness. If you are looking for the best crypto brokers in the UK, these options are highly recommended. Many traders recognize Avatrade for its easy-to-use platform and helpful educational resources.

BlackBull Markets is great for advanced traders because it offers low spreads and strong trading tools.

Exness is popular for its clear pricing and low fees, making it perfect for budget-minded traders.

Key Takeaways: Top 5 Crypto Brokers in the UK

- Avatrade is beginner-friendly with a simple platform, demo accounts, and FCA regulation.

- BlackBull Markets offers low spreads and advanced tools, ideal for seasoned traders.

- Exness stands out with low fees, transparent pricing, and 24/7 support.

- Plus500 excels in mobile trading with a user-friendly app and no commissions.

- FxPro provides diverse instruments and robust platforms, perfect for portfolio diversification.

Best Cryptocurrency Brokers in the UK for 2025

In the rapidly evolving world of digital assets, finding the best cryptocurrency broker in the UK can be daunting. With numerous trading platforms and crypto exchanges available, choosing the right broker is critical for a seamless trading experience.

This guide looks at five top brokers: Avatrade, BlackBull Markets, Exness, Plus500, and FxPro. It will help you invest in cryptocurrencies with confidence.

How We Tested & Rated

Cryptocurrency is changing the financial scene in the UK. Nearly 4.97 million people own some type of crypto asset. This is almost 10% of the population.

Despite its growing popularity, the complexities of the crypto market can deter many from diving in. That’s where we step in to simplify the process.

Using our expertise, we evaluated these brokers based on the following key criteria:

- BTC Trading Fees: How competitive the fees are compared to other brokers.

- Deposit Fees: Transparency and low proce of deposit-related charges.

- GBP Deposit Methods: Wide range of methods and ease of payment methods for UK users.

We also considered other factors such as platform usability, educational resources, and additional features.

The Financial Conduct Authority (FCA) regulates all the brokers we reviewed. They offer apps that work on both Android and iOS. This makes trading easy and convenient.

Why Trust Us?

We have years of experience in retail investment and cryptocurrency in London. We have worked with some of the biggest names in the market. Our hands-on testing of these platforms ensures an unbiased and thorough evaluation.

We tested every platform for functionality, security, and ease of use. Many of these platforms are ones we use ourselves. We recommend only those brokers we’d trust for our own investments. Our methodology is transparent, and you can read more about it in our “How We Test” section.

Additionally, industry experts reviewed this article to ensure accuracy and reliability.

Top Cryptocurrency Brokers in the UK

1. Avatrade – Best for Beginners

Avatrade is a top crypto broker in the UK. Many users recognize it for its easy-to-use trading platform and numerous educational resources.

I remember when I first started exploring cryptocurrency trading. Avatrade’s demo account was a great tool. It helped me learn the basics without any financial risk. Today, Avatrade continues to shine with features such as:

- Features: Supports a range of crypto assets and fiat currency pairs.

- Regulation: Fully compliant with the Financial Conduct Authority (FCA).

- Tools: Advanced charting tools and a reliable mobile app for real-time trading.

- Pros:

- Extensive cryptocurrency trading resources.

- Demo account for practice.

- Low fees compared to other brokers.

- Cons:

- Limited support for altcoins.

Wondering which broker would be best for your needs? Explore trusted options and find expert recommendations.

2. BlackBull Markets – Best for Advanced Traders

BlackBull Markets stands out for its robust trading platforms and low spreads. Last year, I tried out high-frequency trading strategies. I found BlackBull’s tight spreads and smooth MT5 integration very efficient. It’s an excellent choice for experienced traders who buy cryptocurrency in the UK frequently.

- Features: Access to various cryptocurrencies and fiat currency trading pairs.

- Regulation: Licensed by top-tier regulatory bodies, ensuring protections if something goes wrong.

- Tools: Seamless integration with MT5 for advanced trading.

- Pros:

- Tight spreads for high-frequency trading.

- Advanced analysis tools for the crypto market.

- Supports cryptocurrency brokers UK-wide.

- Cons:

- Minimum deposit requirement may deter beginners.

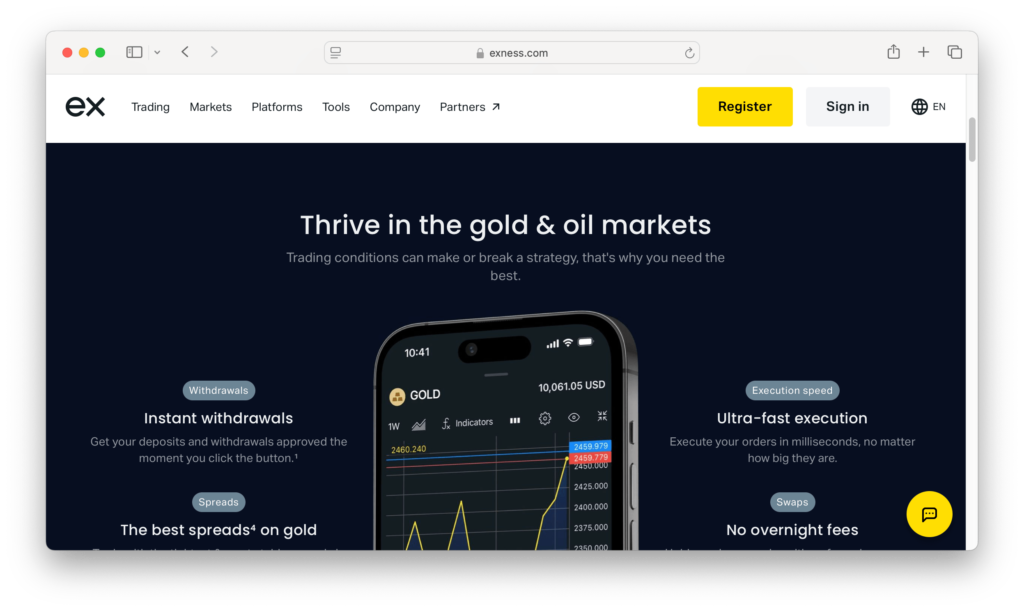

3. Exness – Best for Low Fees

For traders seeking cost efficiency, Exness is the best place to buy Bitcoins in the UK. Recently, I introduced a friend to Exness who was keen on minimizing trading fees.

Exness has clear pricing and a user-friendly platform. This made a strong impression on both of us. With transparent pricing and high liquidity, it’s an ideal broker for cryptocurrency trading.

- Features: Wide range of crypto assets with real-time market data.

- Regulation: Adheres to FCA guidelines for financial safety.

- Tools: High-speed execution and robust mobile app functionality.

- Pros:

- Competitive trading fees.

- Wide selection of crypto assets.

- 24/7 customer support.

- Cons:

- Platform may feel overwhelming for new traders.

4. Plus500 – Best for Mobile Trading

Plus500 is a UK-based crypto exchange tailored for traders who value convenience. Last month, during a trip, I relied solely on Plus500’s mobile app for quick trades, and its intuitive design made the process seamless. Its intuitive mobile app ensures you can trade on the go.

- Features: Simplified user interface with access to popular cryptocurrencies.

- Regulation: Fully regulated under the FCA, offering strong investor protections.

- Tools: Real-time notifications and market insights.

- Pros:

- No commission fees.

- Excellent mobile trading app.

- Comprehensive risk management tools.

- Cons:

- Limited advanced trading features.

5. FxPro – Best for Comprehensive Offerings

FxPro excels in providing a balanced platform suitable for diverse trading needs. Looking ahead, I plan to use FxPro’s diverse trading instruments to explore CFDs alongside cryptocurrencies. It’s a great choice for traders looking to invest in cryptocurrencies while exploring other asset classes.

- Features: Access to multiple trading instruments, including crypto, forex, and CFDs.

- Regulation: Stringently regulated by the FCA, ensuring a secure trading environment.

- Tools: Sophisticated trading platforms like cTrader and MT5.

- Pros:

- Comprehensive educational resources.

- Supports advanced trading strategies.

- Diverse range of crypto assets.

- Cons:

- Higher spreads on some cryptocurrencies.

Comparing the Top Cryptocurrency Brokers

|

Trusted Partner

|

Best for Beginners

|

Top Pick

|

|

Our Rating:

4.7

|

Our Rating:

4.9

|

Our Rating:

4.9

|

|

|

|

- Regulation and Licenses: UK (FCA), Cyprus (CySEC), Seychelles (FSC), South Africa (FSCA), Curaçao (CBCS), BVI (FSC)

- Trading Platforms: MT4, MT5

- Leverage: Up to 1:2000

- Minimum Deposit: $10

- Fees: No commissions, spreads from 0.2 pips

- Regulation and Licenses: New Zealand (FSP), Seychelles (FSA), UK

- Trading Platforms: MT4, MT5, cTrader, TradingView, BlackBull CopyTrader, BlackBull Invest

- Leverage: Up to 1:500

- Minimum Deposit: Starting from $0

- Fees: No commissions (For standard accounts)

- Regulation and Licenses: Europe, Australia, Japan, British Virgin Islands, South Africa, Ireland

- Trading Platforms: MT4, MT5, AvaTradeGO App, ZuluTrade, Web-trader

- Leverage: Up to 1:400

- Minimum Deposit: $100

- Fees: No commissions on most trades.

How to Get Started with a Crypto Broker

Take the time to research and compare different brokers to find one that suits your needs. Consider factors such as fees, security, user experience, and the range of cryptocurrencies offered. Utilize online reviews, comparison sites, and expert opinions to gather comprehensive information about each broker. By understanding the pros and cons of each platform, you can make an informed decision that aligns with your trading goals and risk tolerance.

Step 2: Create an Account

Once you’ve chosen a broker, you’ll need to create an account. This typically involves providing some personal information and verifying your identity. The verification process is essential for complying with regulatory standards and ensuring a secure trading environment.

– Be prepared to submit ID documents.

– This includes a passport or driver’s license.

– You also need to provide proof of your address.

– This is necessary to complete the registration process.

Step 3: Deposit Funds

After your account is set up, you’ll need to deposit funds to start trading. Most brokers offer various payment methods, including bank transfers and credit/debit cards. Choose a payment method that suits your convenience and consider any associated fees that may apply. Some brokers also support digital wallets and cryptocurrency deposits, providing flexibility in funding your account.

Step 4: Start Trading

With funds in your account, you can start trading cryptocurrencies. Use the tools and resources provided by your broker to make informed decisions and manage your investments.

Get to know the platform’s trading features. These include limit orders, stop-loss orders, and charting tools. Understanding these tools will help you improve your trading strategy.

Regularly review your portfolio and adjust your investments based on market trends and your financial objectives.

Step 5: Monitor and Adjust Your Portfolio

Once you’ve begun trading, it’s crucial to always monitor your portfolio. Keep an eye on market trends, news, and updates that could impact the value of your investments. Regularly assess your portfolio’s performance and make necessary adjustments to align with your risk tolerance and investment goals. Staying informed and proactive will help you navigate the volatile cryptocurrency market effectively.

Wondering which broker would be best for your needs? Explore trusted options and find expert recommendations.

Why Choose a Cryptocurrency Broker?

Cryptocurrency brokers act as middle-mans between buyers and sellers, offering a platform to trade digital currencies. They offer tools and resources to help you manage your investments.

This makes them a popular choice for beginners and experienced investors. Here’s why you should consider using a cryptocurrency broker:

Ease of Use

Brokers often offer user-friendly platforms that simplify the process of buying and selling cryptocurrencies.

These platforms serve both beginners and experienced traders. They make cryptocurrency trading easier and less complicated. Intuitive dashboards, straightforward navigation, and easy access to market data ensure that users can execute trades with minimal hassle.

Many brokers offer tutorials and guides. These resources help new users learn the platform quickly.

Security

Reputable brokers implement strong security measures to protect your assets and personal information. In an industry rife with cyber threats, choosing a broker with a solid security framework is paramount. Look for brokers that employ end-to-end encryption, secure socket layer (SSL) certificates, and regular security audits. Many top brokers also offer insurance policies to cover potential breaches, providing an added layer of assurance.

Support

Many brokers offer customer support to help you navigate the trading process. Having access to helpful support staff can make a big difference. This is especially true when you have technical problems or urgent questions.

Top brokers typically provide multiple support channels, including live chat, email, and phone support, ensuring timely assistance. Some platforms even offer dedicated account managers for high-volume traders, providing personalized support and guidance.

Educational Resources

Beyond mere trading platforms, brokers often offer extensive educational resources to empower their users. These resources can include webinars, articles, and interactive tutorials aimed at improving trading skills and market understanding.

By choosing a broker that values education, traders can learn about market trends. This helps them create strategies that improve their trading results.

Market Analysis Tools

Advanced market analysis tools are another compelling reason to choose a cryptocurrency broker. These tools can include real-time market data, technical analysis charts, and forecasting models. By leveraging these features, traders can make informed decisions, identify potential trading opportunities, and mitigate risks associated with market volatility.

Futures and CFDs

Cryptocurrency brokers often provide access to trading instruments like futures and CFDs (Contracts for Difference). These let traders guess price changes without owning the actual assets. This gives chances to profit in both rising and falling markets.

Futures and CFDs also come with leverage options, enabling traders to amplify their positions. While high-risk, these instruments are invaluable for experienced traders aiming to diversify their strategies and enhance potential returns.

Key Features to Look for in a Crypto Broker

Security Measures

The security of your assets should be a top priority. Find brokers that provide strong security features. Look for two-factor authentication, encryption, and cold storage options to keep your money safe.

Two-factor authentication (2FA) adds extra security. It requires a second form of verification. This is usually a code sent to your phone.

You need this code to access your account. Cold storage, which keeps your digital assets offline, minimizes the risk of online hacks and breaches.

Additionally, consider brokers who demonstrate a history of transparency and conduct regular security audits to safeguard your investments.

Fees and Commissions

Transaction fees can vary significantly between brokers. Some charge a flat fee per trade, while others take a percentage of the transaction amount. It’s important to understand the fee structure and how it will impact your overall investment.

Be aware of hidden fees, such as withdrawal or inactivity fees, which can add up over time. A comprehensive understanding of the broker’s fee schedule will help you make cost-effective decisions and maximize your returns.

Range of Cryptocurrencies

If you’re interested in more than just Bitcoin, you’ll want to choose a broker that offers a wide range of cryptocurrencies. This allows you to diversify your portfolio and explore different investment opportunities.

Diversification helps reduce risk by spreading investments across different digital assets. Each asset has its own growth potential. Brokers that regularly update their cryptocurrency options give access to new coins. These coins could provide significant returns.

User Experience

A user-friendly interface can make a significant difference in your trading experience. Look for platforms that are easy to navigate and offer clear, concise information.

A clean and intuitive interface can enhance your trading efficiency, allowing you to execute trades quickly and confidently. Also, platforms with dashboards that you can costum to match your style, and alerts can make your trading experience fit your specific needs.

Customer Support

Reliable customer support is essential, especially if you’re new to cryptocurrency trading. Ensure that the broker you choose offers timely and helpful assistance. Around-the-clock support can be invaluable, particularly in a market that operates 24/7.

Consider brokers that offer multilingual support, catering to a diverse user base and ensuring effective communication regardless of language barriers.

Regulatory Compliance

Regulatory compliance is another critical feature to consider when selecting a crypto broker.

Brokers that follow rules from financial authorities offer more security. An example of such an authority is the Financial Conduct Authority (FCA) in the UK. This helps build trust with clients.

Compliance ensures that the broker operates under strict guidelines, protecting traders from fraudulent activities and promoting fair trading practices.

Factors to Consider When Choosing a Broker

- Regulation and Licensing: Ensure the broker is FCA-regulated to guarantee your investments are secure.

- Fees and Costs: Look for brokers with transparent trading fees and no hidden charges.

- Platform Usability: A user-friendly interface is essential, especially for beginners.

- Payment Methods: Opt for brokers supporting versatile payment methods like bank accounts and debit cards.

- Security Features: Features like two-factor authentication and cold storage are crucial for safeguarding your funds.

Final Thoughts

The UK cryptocurrency market has many choices. You can find beginner-friendly brokers like Avatrade. There are also advanced platforms like BlackBull Markets.

If you want to buy cryptocurrency in the UK or invest in crypto assets, it’s important to choose the right broker. Make sure the broker fits your trading style and risk tolerance.

These brokers have strong rules and various options. They also provide advanced tools. This makes it easier to start trading in cryptocurrency. Remember, cryptocurrency investments are high-risk—only invest what you are prepared to lose.