As the global energy sector navigates through a period of heightened volatility, International Seaways Inc. (NYSE: INSW) emerges as a compelling investment opportunity.

Key Points

- Strong Fundamentals: High ROE of 27% and 56% net income growth over five years, surpassing industry averages.

- Undervalued Stock: Low P/E (3.44) and P/B (0.93) ratios indicate significant undervaluation.

- Recent Developments: Inclusion in the S&P SmallCap 600 index enhances visibility and investment potential.

- Strategic Reinvestment: Retains 96% of profits for growth while balancing shareholder returns.

- High Dividend Yield: Offers an attractive 15.12% yield, far above industry norms.

Even with recent stock declines, INSW shows strong financial performance. Its smart market position and inclusion in the S&P SmallCap 600 index show it could be a good undervalued asset.

This article looks at the company’s technical and fundamental aspects. It also examines its role in the energy sector. Finally, it explains why this company is a good choice for investors looking for long-term value.

Company Overview

International Seaways Inc. is one of the biggest tanker companies in the world. They offer energy transportation services for crude oil and petroleum products.

The company operates a modern and fuel-efficient fleet, ensuring cost-effective and environmentally friendly transportation solutions. INSW focuses on being efficient and reinvesting wisely. This helps them play an important role in the global energy supply chain.

Recent Developments

Inclusion in the S&P SmallCap 600 Index

On December 30, 2024, International Seaways (INSW) replaced Consolidated Communications Holdings (CNSL) in the S&P SmallCap 600 index. This milestone greatly improves INSW’s visibility in the market.

It also makes the company more appealing to institutional investors. When a company is included in an index, passive funds often have to buy its shares.

About $65-$70 billion in assets track the S&P SmallCap 600. This leads to more trading activity and possible price increases for the stocks included.

This inclusion shows that INSW is an important player in the energy sector. It opens the door to more liquidity and interest from investors.

This move strengthens the company’s position in the market. It also aligns the company with other small-cap energy stocks. This signals potential for long-term growth.

Termination of Retiree Health and Welfare Plan

INSW has decided to end its retiree health and welfare plan. This change will take effect on January 2, 2025. This move aims to reduce operational costs.

The board made this decision on December 26. It shows the company's commitment to improving financial efficiency. The company also wants to meet its obligations to plan participants.

Accrued and unpaid benefits will be distributed in lump-sum payments to participants within 12 to 24 months. The announcement was met positively by the market, with INSW shares rising approximately 4% in after-hours trading.

This strong investor response highlights confidence in the company’s proactive cost management and its ability to balance fiscal responsibility with shareholder value creation.

Financial Strength

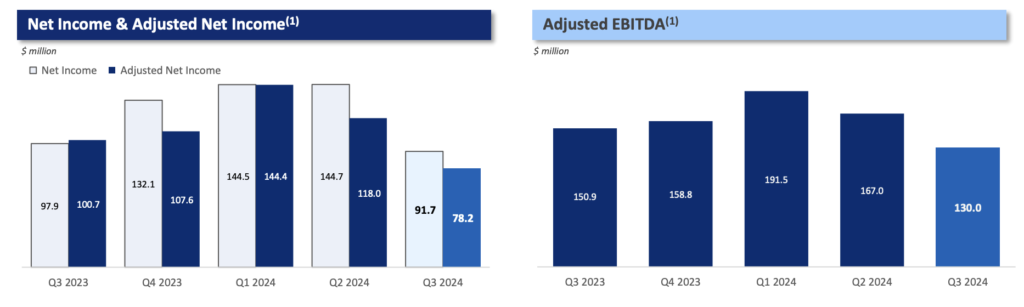

Impressive Profitability Metrics

International Seaways (INSW) has an impressive Return on Equity (ROE) of 27%. This is much higher than the industry average of 15%.

This highlights the company’s exceptional efficiency in converting shareholder investments into profits.

In the last five years, INSW has shown a strong net income growth of 56%. This is much higher than the industry’s average growth rate of 41%.

These strong profit numbers show that INSW has solid fundamentals. The company consistently provides value to its shareholders. This cements its role as a leader in its industry.

| Metric | Value | Industry Average | Rating | What It Means |

|---|---|---|---|---|

| Return on Equity (ROE) | 27% | 15% | Strong Buy | Exceptional profitability and efficiency in utilizing shareholder investments. |

| Net Income Growth (5Y) | 56% | 41% | Strong Buy | Significant earnings growth, far outpacing industry peers. |

Low Valuation Ratios

- Price-to-Earnings (P/E): 3.44

- Price-to-Book (P/B): 0.93

These exceptionally low valuation ratios suggest that INSW is significantly undervalued relative to its intrinsic worth. This big discount is a great opportunity for investors who care about value. They can benefit from the company’s strong financial situation.

Even with market ups and downs, INSW’s strong profits and solid assets make it an attractive investment.

| Metric | Value | Industry Average | Rating | What It Means |

| Price-to-Earnings (P/E) | 3.44 | 8-12 (approx.) | Buy | Trading at a significant discount, indicating potential for price appreciation. |

| Price-to-Book (P/B) | 0.93 | 1.5 | Strong Buy | Undervalued compared to intrinsic worth, signaling an attractive entry point for investors. |

Strategic Reinvestment

INSW uses a smart plan for reinvestment. It has a median payout ratio of only 4.1%. This means it keeps 96% of its profits to support future growth.

This focused strategy has helped the company grow its earnings a lot. It also sets the company up for continued growth in the future.

Analysts expect the payout ratio to rise to 63% in the next three years. This may slow down earnings growth a bit. But, this expected change shows the company’s commitment to balancing reinvestment and better returns for shareholders. It aims for sustainable growth while still appealing to income-focused investors.

| Metric | Value | Industry Average | Rating | What It Means |

| Median Payout Ratio | 4.1% | 30-40% (approx.) | Buy | High reinvestment rates indicate a strong focus on future growth and expansion. |

| Future Payout Ratio | 63% | N/A | Hold | Reflects a shift towards balancing growth and shareholder returns, which may slow growth. |

Sector Analysis

The energy sector is currently navigating a complex landscape shaped by geopolitical tensions, shifting demand patterns, and evolving policy frameworks. These dynamics have significant implications for companies like International Seaways (INSW), which specializes in energy transportation.

Geopolitical Tensions

Current conflicts, like the war in Israel and the situation in Russia and Ukraine, have changed energy supply routes. This has led to a shift in global oil flows.

For example, Middle Eastern oil exports to Europe fell by 22% in 2024. Meanwhile, U.S. and South American oil gained market share in Europe.

Shifting Demand Patterns

Asia’s crude oil imports decreased by 1.4% in 2024, marking the first decline in three years, primarily due to weakened demand from China. This trend raises questions about future demand trajectories in key markets.

Evolving Policy Frameworks

The expected policy changes under President-elect Donald Trump could affect energy trade and the Paris Agreement. These changes create more uncertainty in the energy sector. These developments could influence global energy markets and regulatory environments.

Implications for INSW

In this volatile environment, INSW’s role in energy transportation becomes increasingly critical. The company can adapt to changing trade routes and demand. This makes it a strong player in the industry. Moreover, its recent inclusion in the S&P SmallCap 600 index enhances its market visibility and could attract increased investment.

Current Market Conditions

- Crude Oil Prices: As of January 7, 2025, West Texas Intermediate (WTI) crude oil costs about $70.62 per barrel. Brent crude is priced at $74.06 per barrel.

- Natural Gas Prices: Futures have experienced volatility, with recent declines reflecting market uncertainties.

INSW’s operational efficiency and strategic positioning enable it to navigate these market conditions effectively, maintaining stability amid price fluctuations.

Recent Stock Performance

Despite its strong fundamentals, INSW’s stock has experienced a decline of approximately 22% over the past three months. This downturn can be attributed to several factors:

Market Sentiment: Broader market volatility and sector-specific challenges have contributed to a cautious investor outlook, impacting stock performance.

Analyst Downgrades: On October 23, 2024, Stifel Nicolaus changed INSW’s rating from “buy” to “hold.” They also lowered the price target from $69.00 to $56.00. This shows lower expectations for the company’s performance in the near future.

Earnings Projections: Analysts expect earnings to drop compared to last year. The expected EPS is $2.38, which is down 27.88% from the same quarter last year. Revenue is also projected to decrease by 13.27%. זקס

Why INSW is Undervalued

High Dividend Yield

With an estimated yield of 15.12%, INSW offers a highly attractive income stream for investors. This yield significantly outpaces industry norms and underscores the company’s commitment to returning value to shareholders.

Strong Liquidity and Low Debt

- Quick Ratio: 3.60

- Current Ratio: 3.60

- Debt-to-Equity Ratio: 0.35

These metrics highlight INSW’s strong liquidity and conservative leverage, ensuring financial stability and flexibility in navigating market challenges.

Growth Opportunities

The company is in the S&P SmallCap 600 index. Its focus on reinvestment builds a strong base for future growth. Additionally, the increasing global demand for energy transportation, driven by geopolitical tensions and economic recovery efforts, bodes well for INSW’s long-term prospects.

Conclusion

International Seaways Inc. stands out as an undervalued stock with robust financial fundamentals, strategic market positioning, and promising growth opportunities. Being part of the S&P SmallCap 600 index shows its potential.

Strong operational metrics make it a valuable addition to any investment portfolio. While market volatility and geopolitical uncertainties persist, INSW’s resilience and profitability make it a compelling choice for investors seeking both income and growth.

If you want to invest in a good opportunity in the energy sector, consider International Seaways Inc. Its strong fundamentals, commitment to shareholder value, and strategic positioning within a critical industry sector present an opportunity that is difficult to overlook.