Cryptocurrency is exciting and can be a good way to invest your money. But, just like any new technology, there are people who try to trick others and steal their money. If you want to invest in crypto, it’s important to know how to spot common scams in crypto investing and protect yourself. Here are some simple tips to help you stay safe from common scams in crypto investing.

1. Do Your Research

Before you invest in any cryptocurrency or project, take some time to learn about it. Check who is behind the project. Are they real people with good reputations? Look for reviews and news about the project. If you can’t find much information, or if it sounds too good to be true, be careful. You can also search online to see if others have reported it as one of the common scams in crypto investing.

2. Watch Out for Imposters and Phishing Scams

Scammers often pretend to be someone you trust, like a company, a famous person, or customer support. They might send you emails, messages, or even call you. Never share your private keys, passwords, or secret codes with anyone. Real companies will never ask for this information. If you get a strange message or email, double-check the sender before you reply or click any links to avoid common scams in crypto investing.

3. Beware of Unrealistic Promises

If someone promises you huge profits with no risk, it’s probably a scam. Crypto investing can make money, but it can also lose money. Be careful of anyone who says you will get rich quickly or offers “guaranteed” returns. These are classic warning signs of common scams in crypto investing.

4. Use Reputable and Regulated Exchanges

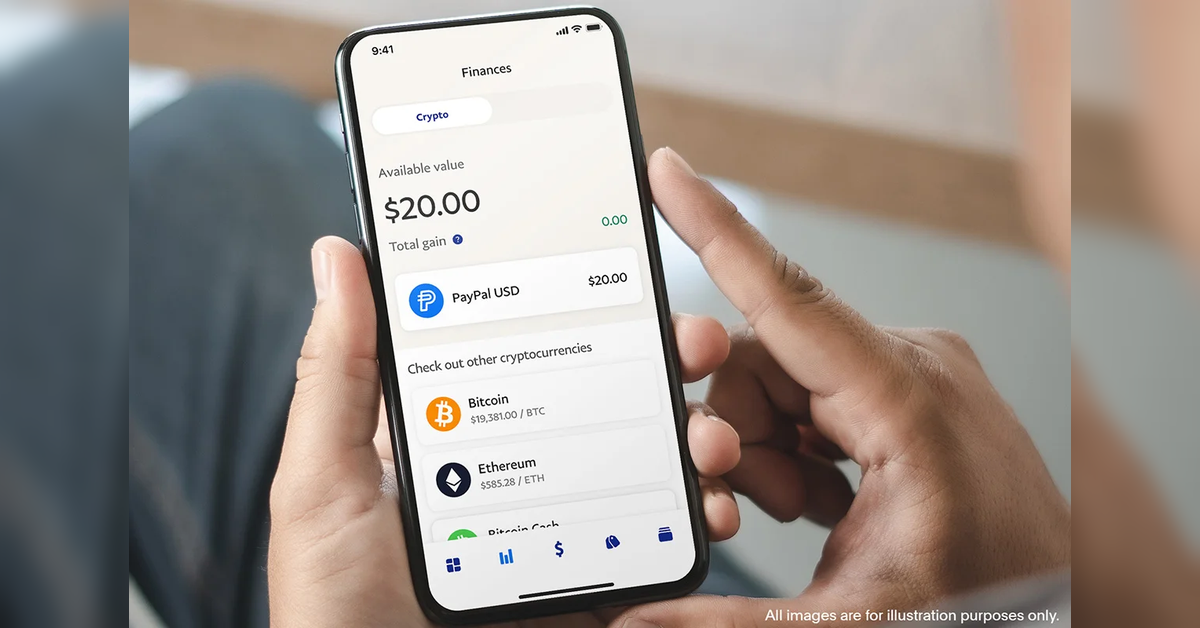

Only buy and sell crypto on well-known and trusted exchanges. Check if the exchange is regulated and has good reviews from other users. Avoid using unknown websites or apps, as they might be fake and could steal your money. This helps you avoid falling victim to common scams in crypto investing.

5. Avoid Unsolicited Offers

If you receive a message or email from someone you don’t know, be careful. They may offer you a special investment opportunity. Scammers often contact people out of the blue. Don’t trust offers that come to you without you asking for them. Always check if the offer is real before you do anything.

6. Understand the Technology

Take some time to learn the basics of how cryptocurrency works. Know what a wallet is, how to keep your private keys safe, and how transactions work. The more you know, the harder it is for scammers to trick you with common scams in crypto investing.

7. Secure Your Accounts

Protect your crypto accounts with strong passwords and use two-factor authentication (2FA) if possible. This adds an extra layer of security. Also, be careful when using public Wi-Fi, and consider using a VPN for extra safety.

8. How to Report Scams

If you think you have found a scam, report it to the authorities in your country. You can also tell the crypto exchange or platform where the scam happened. Reporting scams helps protect other people from being tricked.

Conclusion

Crypto investing can be fun and rewarding, but you need to be careful. Always do your research, watch out for scams, and protect your information. If something feels wrong or too good to be true, it’s best to stay away. By following these simple steps, you can keep your money safe and enjoy your crypto journey without falling for common scams in crypto investing.

Crypto Security FAQs

1. What are the most common crypto scams to watch out for?

Common crypto scams include Ponzi schemes, fake Initial Coin Offerings (ICOs), phishing scams, pump-and-dump schemes, and fake cryptocurrency wallets.

2. How can I verify the legitimacy of a cryptocurrency exchange?

To verify an exchange’s legitimacy, check for regulation, look for secure websites (HTTPS), read user reviews, and confirm its registration with financial authorities.

3. What should I do if I suspect I’ve been targeted by a phishing scam?

If you suspect phishing, do not click on any links, report the scam to the exchange or platform, and immediately change your passwords.

4. How can I protect my private keys and seed phrases?

Store your private keys and seed phrases offline in a hardware wallet, avoid online storage, and never share them with anyone.

5. What are some red flags to identify a fake crypto investment opportunity?

Red flags include unrealistic returns, lack of transparency, no verifiable track record, and high-pressure sales tactics.