Pip Calculator

A Pip Calculator is an essential tool for forex traders, helping you determine the value of a pip for various currency pairs. Knowing the pip value allows you to accurately manage risk and calculate potential profits or losses. Simply enter your trade size, currency pair, and account currency, and our calculator will instantly provide the pip value. This ensures you make informed trading decisions with precision, improving your overall trading strategy.

Table of Contents

What is a Pip?

A pip stands for “percentage in point” or “price interest point.” It is the smallest price movement in the exchange rate of currency pairs. For most pairs, one pip is at the fourth decimal place (0.0001).

For Japanese yen pairs, it’s at the second decimal place (0.01). These tiny movements are critical because they help measure changes in value.

Why Use a Pip Value Calculator?

The calculator tells you how much a single pip is worth in your trading account. This value depends on your account currency, the currency pair you are trading, and the trade size (lot size).

For example:

- If you are trading EURUSD and your account is in USD, the pip value is $10 for one standard lot (100,000 units).

- If you trade GBPJPY with an account in USD, the value will vary based on the exchange rate.

This calculation helps traders set stop losses, predict potential profits or losses, and make better decisions about lot sizes. Without it, mistakes can happen, leading to losing money.

How to Calculate Pip Value

Here’s the formula:

Pip Value = (1 pip / Exchange Rate) x Lot Size

Let’s take EURUSD as an example. If the exchange rate is 1.05634 and you are trading a standard lot (100,000 units), the value is:

(0.0001 / 1.05634) x 100,000 = $9.46

If your account currency is EUR, the pip worth changes because of the account currency’s exchange rate to USD.

Practical Advice for Using a Pip Calculator

Manage Risks

Trading forex involves high risk. Many accounts lose money because traders don’t plan for losses. Use the calculator to set stop losses that align with your risk tolerance.

For example, if you can afford to lose $100 on a trade, adjust your lot size or pip target to match.

Choose the Right Lot Size

Lot size affects the worth of each pip . A standard lot is 100,000 units, while a mini lot is 10,000 units, and a micro lot is 1,000 units. Smaller lot sizes reduce potential losses but also lower potential gains. A pip calculator helps balance this trade-off.

Monitor Multiple Currency Pairs

Pip values vary across pairs. Calculating these values helps you understand your exposure and plan better. For instance:

| Currency Pair | Pip Value |

|---|---|

| EURUSD | Pip value is often $10 for a standard lot in a USD account. |

| USDJPY | Pip value changes with the exchange rate (e.g., 149.958). |

Factor in Fractional Pips

Modern forex trading platforms use fractional pips, also called pipettes. These represent 1/10th of a pip and allow for more precise pricing.

For instance, in EURUSD, the price might move from 1.05634 to 1.05635—a movement of one fractional pip. A pip calculator can include these finer details.

Tips to Make Money with a Pip Calculator

Plan your trades before opening a position, and use the calculator to measure potential profits or losses.

For example, if trading EURUSD with a stop loss 20 pips away, a pip value of $10 means you’re risking $200.

Ensure this matches your risk management strategy.

Trade high-volatility pairs like GBPJPY and USDZAR can have larger movements, offering opportunities for higher profits. Use the calculator to see how pip values and potential returns differ for these pairs.

Use proper risk disclosure:

Never trade more than you can afford to lose. A pip calculator shows how your lot size and stop losses affect your trades. It helps you avoid over-leveraging your trading account.

Stay updated on exchange rates:

Exchange rates impact pip values. Regularly check the rates to ensure accurate calculations.

Combine with other tools:

Pair the pip values calculator with tools like profit calculators or margin calculators. Together, they give a full picture of your trades, from required margins to potential profits or losses.

Common Examples

Here’s how pip values differ across popular pairs:

| Currency Pair | Exchange Rate | Pip Value (Standard Lot) |

|---|---|---|

| EURUSD | 1.05634 | $9.46 |

| GBPUSD | 1.27392 | $7.85 |

| USDJPY | 149.958 | $6.67 |

| AUDUSD | 0.63895 | $15.65 |

| USDCHF | 0.87883 | $11.38 |

Forex Pip Calculator

A forex pip calculator is a tool that helps traders find the money value of a pip change in a forex trade.

A pip (percentage in point) is the smallest price change in the forex market. It usually represents a change in the fourth decimal place (0.0001) of a currency pair’s price.

* For pairs involving the Japanese Yen, a pip is measured at the second decimal place (0.01).

The pip calculator makes it easier to calculate possible profit or loss. It helps traders manage risks and plan trades more accurately.

Key Inputs for a Forex Pip Calculator

To calculate the value of a pip, the following inputs are typically required:

- To calculate the value of a pip, the following inputs are typically required:

- Position Size: This is the number of units or lots you are trading. For example, you can trade micro-lots of 1,000, mini-lots of 10,000, or standard lots of 100,000 units.

- Exchange Rate: The current or expected price of the currency pair.

- Account Currency: The base currency of the trader’s account, as it determines how pip values are converted.

How a Forex Pip Calculator Works

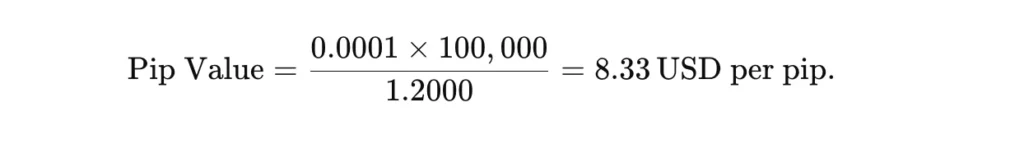

For a standard lot (100,000 units), the formula for calculating pip value is:

For example:

- If you’re trading EUR/USD with an exchange rate of 1.2000, a 1-pip movement (0.0001) would equal:

GBPUSD Pip Calculator

A GBP/USD pip calculator is an important tool for forex traders. It helps them with the British Pound and US Dollar pair.

In forex trading, a “PIP” stands for: “percentage in point” It is the smallest price change a currency pair can make. This change is usually measured to the fourth decimal place, which is 0.0001.

For pairs like GBP/USD, a pip usually equals $10 for a standard lot of 100,000 units. However, the exact value can change based on the trade size and the current exchange rate.

EURUSD Pip Calculator

An EUR/USD pip calculator works like other pip calculators. However, it is designed for the Euro to US Dollar pair. This pair is the most traded forex pair in the world.

Since EUR/USD is a major pair, calculating its forex pip value is simple. This makes it popular with both new and experienced traders.

For EUR/USD, a pip movement is typically valued at $10 for a standard lot when the account currency is USD. This value can fluctuate slightly based on the exchange rate but remains relatively stable compared to other pairs.

Indices Pip Calculator

An indices pip calculator is designed for traders dealing in stock indices such as the S&P 500, Dow Jones, or FTSE 100. Unlike forex pairs, the pip value for indices depends on the specific index, contract specifications, and account currency.

For example, if you trade the S&P 500 with a contract, a one-point movement equals $50. The calculator will find the pip value based on your position size.

| Asset Name | Standard Pip Value | Decimal Precision |

|---|---|---|

| Euro/US Dollar | 0.0001 | 4 (e.g., 1.2345) |

| British Pound/USD | 0.0001 | 4 (e.g., 1.5678) |

| USD/JPY | 0.01 | 2 (e.g., 110.12) |

| AUD/USD | 0.0001 | 4 (e.g., 0.7543) |

| USD/CHF | 0.0001 | 4 (e.g., 0.9245) |

| USD/CAD | 0.0001 | 4 (e.g., 1.2534) |

| EUR/GBP | 0.0001 | 4 (e.g., 0.8674) |

| S&P 500 | 1.0 | 1 (e.g., 4401.0) |

| Dow Jones | 1.0 | 1 (e.g., 34001.0) |

| NASDAQ 100 | 1.0 | 1 (e.g., 14501.0) |

| FTSE 100 | 1.0 | 1 (e.g., 7101.0) |

| DAX 40 | 1.0 | 1 (e.g., 15401.0) |

| Nikkei 225 | 1.0 | 1 (e.g., 28001.0) |

| Hang Seng | 1.0 | 1 (e.g., 24001.0) |

Crypto Pip Calculator

A crypto pip calculator is a key tool for traders in cryptocurrencies. This is especially true for those trading pairs like Bitcoin/USD (BTC/USD) or Ethereum/USD (ETH/USD).

In trading, a “pip” (percentage in point) is a standard unit of measurement for the price movement of an asset.

Pips are often linked to forex trading. However, they are also helpful for cryptocurrency traders. Traders use pips to calculate possible profit or loss from market changes.

In cryptocurrency trading, a pip usually means a change of 0.0001 in the asset’s price. This can vary based on the platform and the trading pair.

A pip calculator helps traders find the money value of a pip movement. It does this based on their position size, trading pair, and leverage.

How Does a Crypto Pip Calculator Work?

A crypto pip calculator simplifies complex calculations, saving traders time and reducing errors. To use the calculator, you typically need to input the following:

- Trading Pair: Select the cryptocurrency pair you’re trading (e.g., BTC/USD, ETH/USD).

- Position Size: Enter the amount of the base currency (e.g., BTC or ETH) you’re trading.

- Price: Input the current price of the asset or the expected entry price.

- Leverage (if applicable): For margin trading, specify the leverage used.

The calculator then determines the value in the quote currency (e.g., USD). This value represents the monetary impact of a one-pip movement on your position.

| Crypto Asset | Standard Pip Value | Decimal Precision |

|---|---|---|

| Bitcoin (BTC) | 0.01 | 2 (e.g., $25,000.01) |

| Ethereum (ETH) | 0.01 | 2 (e.g., $1,500.01) |

| Binance Coin (BNB) | 0.01 | 2 (e.g., $300.01) |

| Solana (SOL) | 0.01 | 2 (e.g., $20.01) |

| Cardano (ADA) | 0.0001 | 4 (e.g., $0.3001) |

Avoiding Common Pitfalls

Ignoring account currency: If your account is in GBP but you trade EURUSD, the pip value won’t be in GBP unless converted. A pip calculator simplifies this step.

Overlooking fractional pips: These smaller units can add up, especially in high-frequency trading. Always factor them in for precise calculations.

Neglecting risk management: Without setting proper stop losses, even a small pip movement can lead to large losses. Use the calculator to determine how much you’re risking per trade.

Start Small and Learn

New traders should begin with micro lots (1,000 units) to minimize risks. For instance, trading USDJPY with a micro lot means each pip is worth $0.10 instead of $10 for a standard lot. This allows you to practice without losing money quickly.

Summary

A Pips value calculator is a must-have tool for forex traders. It simplifies the process of calculating potential profits or losses and helps manage risks effectively.

By learning about pip values and using the calculator well, you can make smart choices. This helps you trade with confidence and lowers the risk of losing money.

Always stay aware of exchange rates, lot sizes, and account currency to make the most of your trading opportunities.

Trade with A regulated Broker

frequently asked questions (FAQ)

Pip Value = (1 pip / Exchange Rate) x Lot Size

For example, in EUR/USD with an exchange rate of 1.05634 and a standard lot size (100,000 units):

(0.0001 / 1.05634) x 100,000 = $9.46

- Standard Lot (100,000 units): $10 per pip for most pairs (e.g., EURUSD).

- Mini Lot (10,000 units): $1 per pip.

- Micro Lot (1,000 units): $0.10 per pip.