In simple terms, it’s a tool used to compare the annual interest across different financial products. It’s a crucial metric in finance, helping investors and savers make informed decisions.

By the end of this guide, you’ll have a clear understanding of the Annual Equivalent Rate. You’ll also learn how to use it effectively in your financial planning.

So, let’s dive in and demystify the Annual Equivalent Rate..

The Importance of AER in Financial Decisions

AER plays a crucial role in financial planning. It helps you make informed decisions by providing a clear picture of expected returns. Understanding AER ensures that you’re comparing investment options accurately.

The clarity AER offers is invaluable when considering long-term savings goals. It factors in compounding, which can significantly boost your returns over time. Without AER, it would be challenging to gauge which investment offers the best potential growth.

Moreover, AER empowers consumers by enhancing financial literacy. By grasping AER, you can sift through flashy interest rate promotions and avoid potential pitfalls. This knowledge is a key component of smart, effective personal finance strategies.

Annual Equivalent Rate vs. Other Interest Measures

AER is often confused with other interest measures like APR. However, they serve different purposes. AER standardizes to reveal true returns considering compounding effects.

APR, the Annual Percentage Rate, primarily shows loan or credit costs. It does not account for compounding, unlike AER, which reflects actual earnings potential. Therefore, AER is more suited for comparing savings products.

With simple interest, your earnings don’t grow exponentially as they do with AER. Simple interest calculations fail to capture the benefit of reinvesting earnings. Thus, AER more accurately represents growth over time.

For many, the distinction between AER and nominal rates can be subtle. Nominal rates might not include compounding, giving an incomplete picture. AER ensures these differences are accounted for effectively.

Understanding these differences clarifies your financial landscape. By comparing AER against other measures, you ensure a comprehensive evaluation of savings and investment options. It’s essential to have this insight for sound financial decisions.

How to Calculate the Annual Equivalent Rate

Calculating the Annual Equivalent Rate (AER) helps compare the true cost or earnings of different financial products. AER considers both the interest rate and the frequency of compounding.

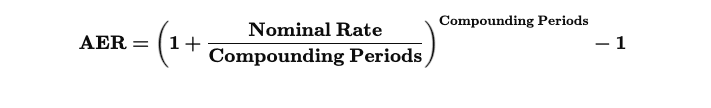

To calculate AER, use the formula: AER = (1 + r/n)^n – 1. In this formula, ‘r’ represents the nominal interest rate, while ‘n’ is the number of compounding periods each year.

Here’s a simple breakdown of how to calculate AER:

- Identify the nominal interest rate (r).

- Determine the number of compounding periods per year (n).

- Apply the values in the AER formula: (1 + r/n)^n – 1.

- Convert the result to a percentage by multiplying by 100.

AER reveals the impact of compounding, differentiating it from simple interest calculations. Each compounding period boosts the rate, increasing final returns.

Knowing how to calculate AER aids in financial decision-making. It enables comparison of diverse savings and investment options without manual adjustments for compounding. While it sounds complex, the formula simplifies financial comparison across varied products.

The Annual Equivalent Rate Formula

The AER formula is crucial for understanding financial growth. It aggregates the effects of compounding into a single rate, providing transparency.

In the formula AER = (1 + r/n)^n – 1, each component serves a purpose. The ‘r’ signifies the nominal rate, explaining the basic interest. The ‘n’ indicates compounding frequency, crucial for accurate calculation.

This formula allows for straightforward comparisons between different financial products. It standardizes interest rates, accounting for varying compounding periods. As a result, you gain a true sense of potential earnings.

Step-by-Step Calculation Example

Consider an account with a 5% nominal interest rate, compounding quarterly. First, convert the 5% nominal rate into decimal form: r = 0.05.

Next, identify the compounding frequency. Since it compounds quarterly, there are 4 periods each year, so n = 4.

Apply these values to the formula: AER = (1 + 0.05/4)^4 – 1. This simplifies to (1 + 0.0125)^4 – 1. Compute to find AER = 1.050945 – 1.

This results in an AER of approximately 0.050945, or 5.0945% when expressed as a percentage.

Through this calculation, observe how quarterly compounding slightly elevates the effective rate. This highlights the powerful impact of compounding.

By understanding the AER formula and its components, you can confidently compare returns. Use AER to assess various savings accounts, ensuring optimal financial choices.

Real-World Applications of AER

The Annual Equivalent Rate (AER) is an essential financial metric widely used across various sectors to evaluate and compare financial products effectively.

Savings Accounts

Banks and financial institutions rely on AER to illustrate the potential earnings on savings accounts. By providing a standardized measure, AER helps customers understand the growth potential of their deposits over time.

This transparency empowers individuals to make well-informed decisions when choosing where to save their money.

Investment Products

Investment products, such as bonds, also utilize AER as a critical benchmark. It shows the real return on investment after considering compounding. This helps investors compare different options more easily.

This clarity simplifies decision-making, ensuring that investments align with an individual’s financial objectives.

Personal Finance Planning

Financial advisors frequently highlight the importance of AER in personal finance management. Understanding AER enables individuals to identify products with the best potential for growth.

By using this knowledge, people can improve their portfolios. They can also work towards their long-term financial goals with confidence.

In conclusion, AER is a versatile and invaluable tool for assessing savings, investments, and personal finance strategies. Its role in promoting clarity and comparability makes it a cornerstone of sound financial decision-making.

Limitations and Considerations When Using AER

While AER is a valuable metric, it has its limitations. It does not account for fees or taxes, which can significantly impact actual returns. Users must consider these additional costs when evaluating financial products to ensure a comprehensive understanding of their potential earnings.

Compounding periods require careful attention as well. Comparing AERs with different compounding frequencies can lead to misleading conclusions. It is essential to analyze the underlying assumptions and details of each product to make accurate comparisons.

Lastly, the economic environment plays a crucial role in determining AER. Changes in interest rates can directly affect returns over time, influencing financial planning strategies. Being aware of such fluctuations allows individuals to adapt their plans accordingly and mitigate potential risks.

In summary, while AER offers clarity and comparability, understanding its limitations ensures more informed and realistic financial decisions.

FAQ: AER

What Is AER and Why Is It Useful?

The Annual Equivalent Rate (AER) is a standardized way to express the annual interest on a savings or investment product, taking into account the effects of compounding. By converting different compounding schedules (daily, monthly, quarterly, etc.) into a single annual figure, AER allows you to compare diverse financial products on an even playing field and choose the one that maximizes your returns.

How Is AER Calculated?

AER is calculated using the formula:

AER = (1 + r/n)^n – 1

where r is the nominal (stated) interest rate in decimal form and n is the number of compounding periods per year. For example, a 5% nominal rate compounding quarterly (n = 4) would be:

AER = (1 + 0.05/4)^4 – 1 ≈ 0.050945, or 5.0945%

This calculation shows how much you truly earn over a year after accounting for compounding.

How Does AER Differ from APR and Nominal Rates?

– AER reflects the actual annual growth of your deposit or investment by incorporating compound interest.

– APR (Annual Percentage Rate) typically applies to loans or credit and does not account for compounding; it shows the cost of borrowing rather than the yield on savings.

– Nominal (stated) rates may quote an interest rate without revealing how often it compounds, which can be misleading. AER makes those differences transparent so you can see the true annualized return.

What Are the Limitations of Using AER?

While AER is invaluable for comparing raw interest earnings, it does not include any fees, charges, or taxes associated with the product. Two accounts could have identical AERs, but if one levies higher maintenance fees or is taxed at a different rate, your net return will differ. Always factor in fees and potential tax liabilities separately when evaluating a product’s true net benefit.

Key Takeaways and Next Steps

Understanding AER helps you make informed financial decisions by enabling accurate comparisons of financial products. Here’s a quick recap:

- AER standardizes interest rates, providing a consistent measure for evaluating potential returns.

- It excludes fees and taxes, so these must be considered separately.

- Compounding frequency affects the AER, emphasizing the need to review the underlying assumptions of each product.

Consider consulting a financial advisor for tailored advice suited to your unique financial situation. Stay informed and watch market conditions. Regularly check your investments to make sure they match your long-term financial goals.