Dividend yield is a financial ratio. It shows how much a company pays out in dividends each year relative to its share price.

This metric is essential for those invested in dividend stocks. It helps them evaluate the cash return on their investments.

A high dividend yield can be attractive, but it requires careful analysis. It might indicate a good income source, but could also signal potential risks.

Investors need to look beyond the yield. They should consider the company’s overall financial health and market conditions before making decisions.

The Importance of Dividend Yield in Investing

Dividend yield provides insights into a stock’s income potential. It aids in comparing income across different investments.

This yield is crucial for yield investing as it helps in screening high-yield dividend stocks.

Moreover, it serves as an indicator of a company’s financial stability and its ability to pay consistent dividends over time.

Calculating Dividend Yield

Calculating dividend yield is straightforward. It involves a simple formula that considers both annual dividends and the current stock price. Understanding how to calculate dividend yield empowers investors. It provides a clear picture of potential income from investments.

Accurate calculations are essential. They help in comparing the dividend income with other investment opportunities. This metric allows investors to gauge how much return on investment they can expect.

Having a precise calculation is key, especially when evaluating multiple stocks. With this, investors can make informed decisions. This is especially true if they focus on generating passive income through dividends.

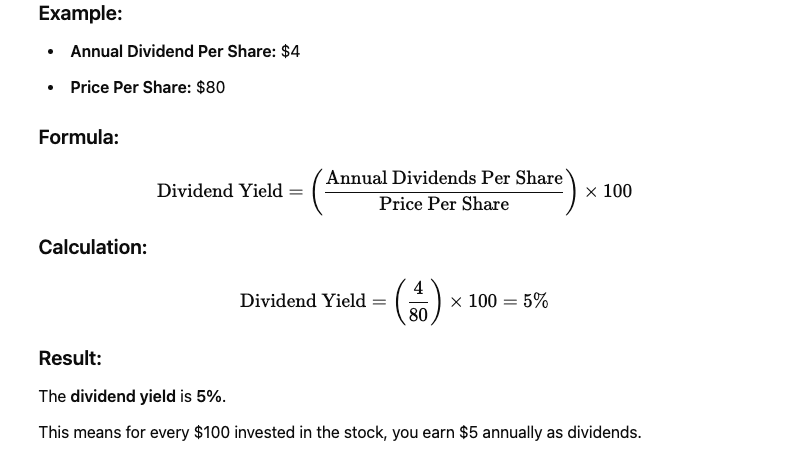

Dividend Yield Formula

To find the dividend yield, use this formula: Dividend Yield = (Annual Dividends Per Share / Price Per Share) x 100.

This formula calculates the percentage of the current stock price that is returned as dividends.

The result represents the annual dividend income you would receive from investing in that stock, expressed as a percentage.

Step-by-Step Calculation Guide

Begin by identifying the annual dividends per share. This is the total of all dividends paid in a year.

Then, find the current price of the stock. You can usually check this through most financial websites or stock market apps.

Now, divide the annual dividends by the stock price. Finally, multiply the result by 100 to convert it to a percentage.

Understanding this step-by-step process is crucial for accurately assessing the investment return in dividends.

Annual Dividend Yield Calculation

Calculating the annual dividend yield requires consistency in updating input data. Ensure that the annual dividends reflect the latest payouts.

Similarly, keep the stock price updated to capture real-time yield changes. Fluctuations in the stock market can impact yields over time.

By maintaining accurate figures, investors can effectively track yield performance throughout the investment horizon.

Dividend Yield for Passive Income

Dividend yield is an essential tool in building passive income. It enables investors to earn consistently from their investments.

This income stream comes without needing to sell any shares. Investors can use it for expenses or reinvest for growth.

The stability of dividend payments offers financial predictability. This aspect is particularly appealing to retirees seeking a steady income.

Generating Passive Income through Dividend Stocks

Dividend stocks are a vehicle for generating passive income. They provide a consistent return on investment.

Selecting stocks with a reliable dividend history is crucial. They indicate a company’s commitment to returning profits to shareholders.

Such investments can form the backbone of an income-focused strategy. They provide a dependable cash flow year after year.

Reinvestment and Growth

Reinvesting dividends can significantly boost portfolio value. It involves using dividend payments to purchase more shares.

This process can enhance compounded growth. The reinvested dividends start generating their dividends, escalating growth.

Over time, this strategy can lead to exponential gains. Investors can build substantial wealth through the power of compounding.

Risks and Considerations

Investors must be cautious of the risks tied to dividend yield investing. A high dividend yield might suggest a troubled company.

Dividends are not guaranteed and can fluctuate based on the company’s financial health. Focusing solely on yield can sometimes lead to poor investment choices.

Consider other financial metrics alongside dividend yield. Doing so ensures a well-rounded analysis of a company’s stability.

Market volatility can also impact dividend payments. Therefore, understanding the broader economic environment is vital before making investments.

High Dividend Yield Traps

High dividend yields can be misleading. They may signal financial instability or an unsustainable payout policy.

Investors should scrutinize the reasons behind an unusually high yield. Is the company compensating for a declining stock price?

Performing thorough research and considering company fundamentals is critical. This approach helps avoid potential pitfalls in yield investing.

Market Conditions and Dividend Yield

Market conditions can significantly affect dividend yields. Economic downturns often lead to dividend cuts.

A fluctuating market might cause stock prices to drop, increasing dividend yields artificially. This scenario might not reflect a company’s true financial health.

Therefore, it’s essential to assess yield in the context of market trends. Understanding these factors can inform smarter investment decisions.

Tools and Resources

There are many tools available to help you analyze dividend yields efficiently. These tools simplify calculations and aid in decision-making.

Online platforms offer real-time data on dividend stocks. They provide insights into market trends and investment opportunities.

Utilizing these resources can enhance your ability to manage investments. They make yield investing more accessible, especially for beginners.

Using Online Dividend Yield Calculators

Online dividend yield calculators make it easy to compute potential returns. They require minimal input, such as stock price and annual dividend.

These calculators can quickly show how different stocks compare. Such insights are crucial in evaluating investment options.

By using these tools, investors can save time. They help build a diversified portfolio with strategic dividend picks.

Frequently Asked Questions

What Is Dividend Yield and Why Is It Important?

Dividend yield shows the annual dividends paid by a company as a percentage of its current share price. It tells investors how much cash return they receive for each dollar invested. A reliable dividend yield helps you compare income potential across different stocks and gauge whether a company consistently generates enough cash to support its payouts.

How Do I Calculate Dividend Yield?

To find dividend yield, divide the total dividends paid per share over the past year by the stock’s current market price, then multiply by 100 to get a percentage. For example, if a company pays $3 in dividends per share and its share price is $60, the yield is 5% (3 ÷ 60 × 100). Always use the latest dividend and price data to get an accurate result.