Many individuals are considering ways to invest in S&P 500 in the UK. For those looking to invest in S&P 500 UK, it is becoming more popular with UK investors who want to diversify their portfolios and access the U.S. market. Whether you’re deciding to invest in s&p 500 uk, there are several options to explore, making it an attractive choice for both seasoned investors and newcomers.

The S&P 500 has a strong history of resilience and growth. It includes the 500 largest public companies in the U.S. This index is a good option for building wealth over the long term.

This guide will help you learn how to invest in the S&P 500 from the UK. It covers methods, costs, risks, and practical steps.

Key Takeaways: Top 5 Crypto Brokers in the UK

- Investment Options: ETFs, mutual funds, index-linked trusts, and CFDs provide various ways to invest in the S&P 500.

- Top Brokers: AvaTrade, BlackBull, and Exness offer seamless access to S&P 500 CFDs with competitive fees.

- Key Benefits: The S&P 500 provides global exposure, consistent growth, and broad diversification.

- Risks: Market volatility, tech-sector reliance, and currency fluctuations can impact returns.

- Tax Efficiency: Use ISAs or SIPPs for tax-free growth and reduced liabilities on dividends and capital gains.

How to Invest in the SP 500: UK Guide

Investing in the S&P 500 is a popular way for UK investors. It helps them access the largest U.S. companies and diversify their portfolios.

While you can’t directly buy the S&P, there are multiple methods to invest, the easiest and most accessible way is through purchasing a CFD (Contract for Difference) with one of our recommended brokers: AvaTrade, BlackBull, or Exness.

These platforms offer seamless access to S&P 500 CFDs with competitive fees and excellent customer support.

Here’s a detailed breakdown of your options:

1. Direct Investment Through ETFs

ETFs are a popular choice for those who prefer simplicity and affordability. They track the S&P 500 index and allow you to benefit from its performance with minimal fees. For instance, I personally started with ETFs and highly recommend them. A friend suggested Vanguard’s S&P 500 UCITS ETF (VUSA), which has been a reliable and cost-effective option.

Popular ETFs Include:

- iShares Core S&P 500 ETF (CSPX)

- Vanguard S&P 500 UCITS ETF (VUSA)

- SPDR S&P 500 ETF Trust (SPY)

These ETFs are available through most UK brokerage platforms and are ideal for long-term investors looking to minimize costs.

Why ETFs Work Well:

- Low Fees: Annual management fees range from 0.03% to 0.07%.

- Passive Investment: ETFs automatically track the index, requiring no active management.

- Accessible: Can be purchased on platforms like Hargreaves Lansdown, Interactive Investor, or even via apps like eToro.

2. Mutual Funds

Mutual funds offer active management and can tailor investment strategies to your financial goals. While some investors prefer the hands-on approach of mutual funds, I’d argue that with today’s online platforms, it’s more cost-effective to manage investments yourself.

Key Features of Mutual Funds:

- Active Management: A professional fund manager oversees the portfolio.

- Higher Fees: Management fees can range from 0.50% to 1.50% annually.

- Diversification: Mutual funds often include exposure to other assets, not just the S&P 500.

However, with user-friendly platforms like AvaTrade or BlackBull, you can bypass the higher fees associated with mutual funds while still benefiting from the S&P 500’s performance.

3. Index-Linked Investment Trusts

For those seeking additional flexibility and dividend reinvestment options, index-linked investment trusts can be a good fit. Some of my clients use this option to align their investments with long-term income generation goals.

Advantages:

- Dividend Reinvestment: Allows for compounding growth.

- Long-Term Focus: Suited for investors with a horizon of 5+ years.

- Tax Benefits: Investment trusts can be held within an ISA or SIPP to reduce tax liability.

However, these require a bit more research and are less straightforward than using brokers offering CFDs.

4. CFDs: The Easiest Way

For the fastest and most user-friendly access to the S&P 500, I recommend purchasing CFDs with one of our trusted brokers. These platforms are ideal for beginners and experienced investors alike.

Why CFDs?

- Simplicity: No need to own the underlying asset—you can trade on price movements directly.

- Leverage: Amplify your investment potential with options for leveraged trading.

- Flexibility: Easily go long or short based on market predictions.

Our Recommended Brokers:

AvaTrade

- Regulated and secure platform.

- Competitive spreads and zero commission.

- Intuitive interface for trading CFDs on the S&P 500.

- Regulation and Licenses: Europe, Australia, Japan, British Virgin Islands, South Africa, Ireland

- Trading Platforms: MT4, MT5, AvaTradeGO App, ZuluTrade, Web-trader

- Leverage: Up to 1:400

- Minimum Deposit: $100

- Fees: No commissions on most trades.

BlackBull

- Excellent for forex and indices.

- Supports advanced trading tools.

- Great customer support for UK investors.

- Regulation and Licenses: New Zealand (FSP), Seychelles (FSA), UK

- Trading Platforms: MT4, MT5, cTrader, TradingView, BlackBull CopyTrader, BlackBull Invest

- Leverage: Up to 1:500

- Minimum Deposit: Starting from $0

- Fees: No commissions (For standard accounts)

Exness

- Known for low spreads and fast execution.

- Flexible leverage options.

- User-friendly mobile and desktop platforms.

- Regulation and Licenses: UK (FCA), Cyprus (CySEC), Seychelles (FSC), South Africa (FSCA), Curaçao (CBCS), BVI (FSC)

- Trading Platforms: MT4, MT5

- Leverage: Up to 1:2000

- Minimum Deposit: $10

- Fees: No commissions, spreads from 0.2 pips

How to Get Started with CFDs:

- Sign Up: Register with AvaTrade, BlackBull, or Exness.

- Fund Your Account: Deposit GBP into your account.

- Select the S&P 500 CFD: Navigate to indices and choose the S&P 500.

- Trade: Decide whether to go long (Buy) or short (Sell), set your leverage, and confirm your trade.

While there are many ways to invest in the S&P 500, purchasing CFDs through trusted brokers like AvaTrade, BlackBull, or Exness stands out as the easiest and most efficient method.

With their simple platforms, low fees, and dedicated customer support, you can gain exposure to the S&P 500 in minutes.

| Investment Method | Key Features | Ideal For | Fees |

|---|---|---|---|

| Direct Investment Through ETFs | Low fees, easy access, passive investment strategy. Popular options: CSPX, VUSA, SPY. | Investors seeking simplicity and cost-effectiveness. | Low management fees (0.03%-0.07% annually). |

| Mutual Funds | Active management, higher fees, tailored investment strategy. | Those preferring professional management for part of their portfolio. | Higher fees (0.50%-1.50% annually). |

| Index-Linked Investment Trusts | Structured investment, flexibility, and options for dividend reinvestment. | Investors wanting flexibility and a structured approach to S&P 500 exposure. | Varies, typically 0.50%-1.00% annually. |

| CFDs | Simplest access to S&P 500 trading, leverage options, and ability to trade on price movements. | Investors looking for flexibility and fast execution with competitive spreads. | No commission, low spreads (varies by broker). |

What is the S&P 500, and Why Should UK Investors Care?

The S&P 500 is a well-known index. It gives UK investors a way to diversify their portfolios. This index helps them achieve steady growth by investing in top U.S. companies.

The S&P 500 represents some of the most influential companies in the world, including Apple, Microsoft, and Amazon. It shows the health of the U.S. economy. It is also a popular choice for investors who want to diversify beyond the UK market.

When I first learned about the S&P 500, I was captivated by its history and global significance.

Some of my colleagues, who invested early. Used to always talk about how holding S&P 500 ETFs helped them. This gave them international diversification and steady growth. Their strategy inspired me to start investing too.

For UK investors, the S&P 500 offers:

- Global Exposure: Many S&P 500 companies operate globally, providing indirect exposure to international markets.

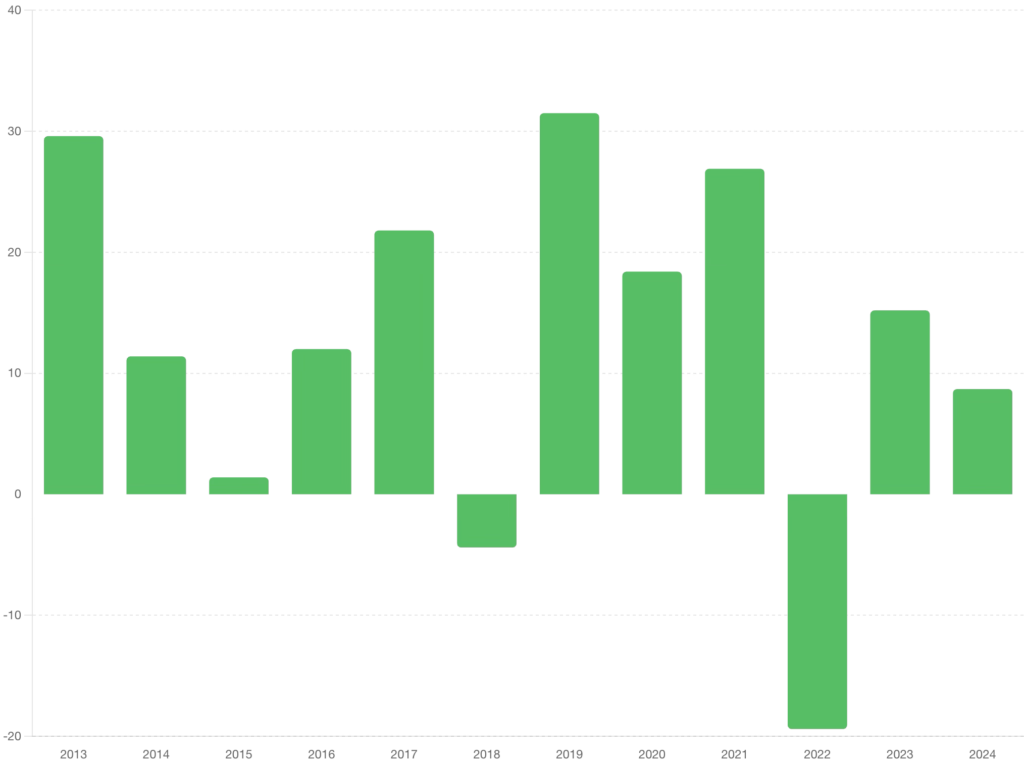

- Consistent Growth: Historically, the S&P 500 has delivered an average annual return of about 10% over the past century.

S&P 500 Annual Returns (2013-2024)

- Diversification: It’s a cost-effective way to invest in a broad range of sectors, from technology to healthcare.

How the S&P 500 Has Performed Over Time

The S&P 500 has demonstrated remarkable resilience and long-term growth, consistently outperforming many other indices, including the FTSE 100.

The S&P 500’s track record shows resilience, innovation, and recovery. Its ability to bounce back from crises and deliver long-term growth has made it a cornerstone of global investing.

This performance underscores why so many investors, including myself, choose it as a foundational part of their portfolios.

I will never forget the market turnaround during the 2020 COVID-19 pandemic. The sudden crash was alarming, and like many others, I hesitated to increase my investments in S&P 500 ETFs.

However, witnessing the rapid recovery of the index was a defining moment. It reinforced my confidence in the long-term potential of the U.S. market.

A colleague of mine, who consistently dollar-cost averaged into the index during that volatile period, saw impressive gains as the market rebounded, solidifying their financial goals.

The S&P 500 has not only endured economic downturns, wars, and recessions but has also thrived, showcasing the resilience of the companies it represents. Here’s why it stands out:

- Historical Growth: The S&P 500 has delivered an average annualized return of approximately 10% over the past century, including dividends, outperforming many other global indices.

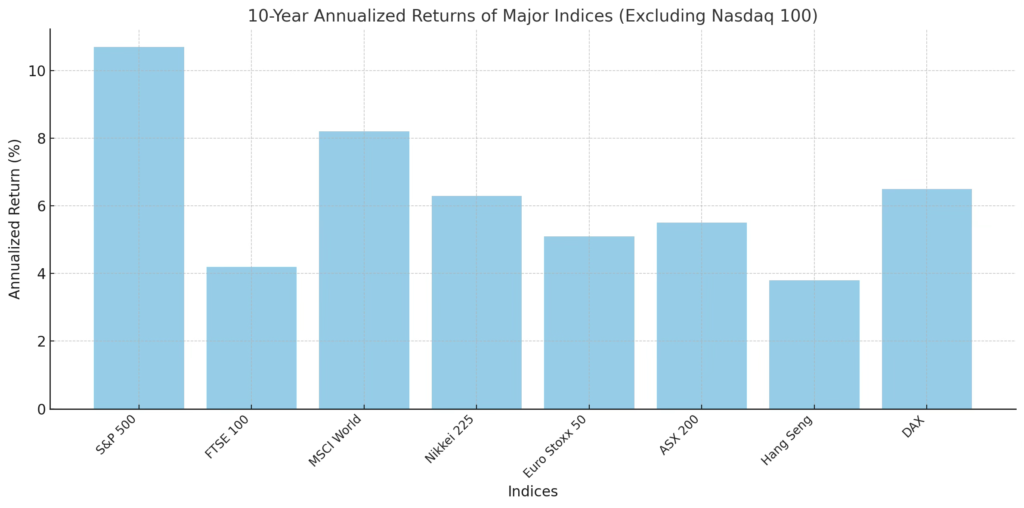

Bar graph comparing the 10-year annualized returns of the S&P 500 with major commodities such as gold, silver, oil, and agriculture

- Rapid Recoveries: In crises such as the COVID-19 pandemic and the 2008 financial crash, the S&P 500 demonstrated quicker and more robust recoveries compared to other indices, such as the FTSE 100.

The S&P 500’s performance can be broken down into key historical milestones that demonstrate its resilience and adaptability:

| Time Period | Major Event | Impact on S&P 500 | Recovery Time |

|---|---|---|---|

| 1987 | Black Monday | Declined 22% in one day | ~2 years |

| 2000-2002 | Dot-Com Bubble Burst | Dropped ~49% | ~7 years |

| 2008 | Global Financial Crisis | Lost ~57% of its value | ~5 years |

| 2020 | COVID-19 Pandemic Crash | Dropped ~34% in a few weeks | ~6 months |

- Global Diversification: Unlike the FTSE 100, which predominantly features UK-based companies, the S&P 500 includes multinational giants that derive significant revenue from global markets, boosting its growth potential.

Comparative Performance

The S&P 500 consistently outperforms other global indices in terms of annualized returns, driven by its composition of innovative and high-growth sectors. Let’s dive deeper into a comparative analysis:

| Index | 10-Year Annualized Return | Sector Strengths | Key Drivers |

|---|---|---|---|

| S&P 500 | ~10.7% | Technology, Healthcare, Consumer Discretionary | U.S. innovation, global revenue streams |

| FTSE 100 | ~4.2% | Energy, Financials, Consumer Staples | Heavy reliance on domestic and mature sectors |

| MSCI World | ~8.2% | Diversified Global Sectors | Broad global exposure, moderate growth |

| Nikkei 225 | ~6.3% | Manufacturing, Technology | Japan’s export-driven economy |

| Euro Stoxx 50 | ~5.1% | Banking, Energy, Industrial Goods | European stability, focus on traditional sectors |

| ASX 200 | ~5.5% | Mining, Financials, Real Estate | Australia’s commodity-driven economy |

| Hang Seng | ~3.8% | Financials, Real Estate, Technology | Hong Kong’s gateway to Chinese markets |

| DAX | ~6.5% | Industrials, Consumer Goods, Technology | Germany’s industrial backbone and export strength |

Why the S&P 500 Leads the Pack:

- Innovation-Driven Growth: The index’s heavy weighting in sectors like technology (e.g., Apple, Microsoft) and healthcare fuels consistent outperformance.

- Global Revenue Streams: Many S&P 500 companies generate substantial revenue from international markets, spreading risk and tapping into global growth opportunities.

- Dynamic Composition: The S&P 500’s periodic rebalancing ensures that the index remains aligned with the most competitive and innovative U.S. companies.

These returns highlight why the S&P 500 remains a preferred choice for investors looking to balance risk and reward while capitalizing on global economic trends.

Lessons Learned

- Long-Term Perspective: History shows that despite short-term volatility, the S&P 500 rewards patience with significant long-term gains.

- Diversification: Its global reach and sectoral variety make it a robust choice for reducing risk.

- Resilience in Crises: Whether it’s a pandemic or a financial meltdown, the S&P 500 demonstrates unparalleled recovery speed compared to other indices.

For investors seeking stability and long-term wealth creation, the S&P 500 remains an excellent choice. Its history of resilience and recovery not only provides financial rewards but also peace of mind in turbulent times.

Wondering which broker would be best for your needs? Explore trusted options and find expert recommendations.

Costs and Fees

Minimizing costs and fees is critical to maximizing your returns when investing in the S&P 500.

When I first started investing, I overlooked the impact of fees. Over time, I realized how important it is to minimize costs to maximize returns.

Here’s a comparison of popular platforms for investing in the S&P 500 from the UK:

| Platform | Annual Fee | Transaction Fee | Available S&P 500 ETFs |

|---|---|---|---|

| Hargreaves Lansdown | 0.45% | £11.95 per trade | VUSA, CSPX |

| Interactive Investor | £9.99/month | Free with regular investing | VUSA, CSPX, SPY |

| AvaTrade | 0% | No commission | CSPX, SPY |

Tax Implications for UK Investors

Tax-efficient accounts like ISAs and SIPPs can help you grow your investments while minimizing tax liabilities.

Navigating taxes was initially daunting for me. Setting up a Stocks and Shares ISA was a game-changer. It helped me grow my investments tax-free, and I recommend it to every beginner.

- Use ISAs or SIPPs: Stocks and Shares ISAs and Self-Invested Personal Pensions (SIPPs) allow for tax-free growth and dividends.

- Dividend Tax: Dividends from U.S. companies may be subject to a 15% withholding tax, which can be reduced through a W-8BEN form.

- Capital Gains Tax: Profits outside of ISAs/SIPPs may be subject to UK capital gains tax.

Currency Risks and Opportunities

Bottom Line, Currency fluctuations between GBP and USD can significantly impact your investment returns.

I’ve learned to keep an eye on the GBP/USD exchange rate. During one of my larger investments, the weakening pound boosted my returns significantly. However, it’s also a reminder that currency risks can cut both ways.

When investing in U.S. assets like the S&P 500, the GBP/USD exchange rate can impact your returns. For instance:

- A stronger dollar increases the value of your U.S. investments in GBP terms.

- A weaker dollar may reduce returns when converted back to GBP.

To manage this risk, consider ETFs with built-in currency hedging.

Top S&P 500 Companies to Watch

The S&P 500 includes many innovative and influential companies. This makes it a top choice for investment.

I’ll never forget when I bought my first Apple shares indirectly through an ETF. Watching its growth over the years has been rewarding, and it’s one of the reasons I’m so passionate about U.S. investments. Here are some influential companies:

- Apple (AAPL): A global leader in technology and innovation.

- Tesla (TSLA): Driving the future of electric vehicles.

- Amazon (AMZN): Dominating e-commerce and cloud computing.

- Microsoft (MSFT): Pioneering advancements in AI and software.

These companies, along with many others in the S&P 500, lead global innovation. This makes the index a good investment.

Practical Step-by-Step Guide to Investing in the S&P 500

Investing in the S&P 500 is straightforward and can be done in five simple steps through various platforms.

- Choose a Platform: Research brokers like AvaTrade. Personally, I use AvaTrade for its intuitive platform and zero commission on certain trades.

- Open an Account: Sign up and verify your identity.

- Fund Your Account: Deposit GBP and, if necessary, convert it to USD. My initial deposit was modest, but it was thrilling to take that first step.

- Select an S&P 500 ETF: Search for ETFs like VUSA or CSPX.

- Invest: Decide on a lump sum or set up regular contributions. I prefer dollar-cost averaging for consistent growth.

Risks to Consider

While the S&P 500 is a strong long-term investment, market volatility and concentration risks should be carefully managed.

During my first year of investing, I saw some market volatility that made me question my decisions. Reflecting now, I’m glad I held steady and maintained a long-term perspective.

- Market Volatility: Short-term fluctuations can lead to losses.

- Sector Concentration: Heavy reliance on tech stocks can increase risk.

- Currency Risk: Exchange rate fluctuations may impact returns.

To mitigate these risks, diversify your investments across different asset classes and geographies.

Ethical and ESG Considerations

ESG-focused ETFs provide a way to invest in the S&P 500 while aligning with your personal values.

I’ve recently started exploring ESG-focused ETFs, inspired by a friend who aligns their investments with their values. These funds exclude companies with poor environmental, social, or governance records, allowing investors to align their portfolios with their values.

Wondering which broker would be best for your needs? Explore trusted options and find expert recommendations.

Conclusion

Investing in the S&P 500 from the UK is a great way to diversify your portfolio. It also helps you invest in some of the world’s most successful companies.

By understanding the options, costs, and risks involved, you can make informed decisions and set yourself on a path to long-term financial growth. Whether you’re a seasoned investor or just starting, the S&P 500 offers opportunities for everyone.