Getting regular money each month from your investments can be a great way to boost your income or help in retirement. The UK offers several investment options that can pay you money monthly or regularly. This article explores different ways to invest your money to receive monthly income in the UK, from safer options to those with higher risks and rewards.

Understanding Monthly Income Investments

Monthly income investments are financial products that provide regular payments to investors, typically every month. These investments can help supplement your salary, support you during retirement, or provide extra money for day-to-day expenses. Many people like monthly income investments because they create predictable cash flow that helps with budgeting and financial planning.

When looking at monthly income investments, it’s important to understand that higher potential returns usually come with higher risks. Safer investments typically offer lower returns, while investments with higher potential returns often carry greater risks. Finding the right balance depends on your personal situation, how much risk you’re comfortable with, and your financial goals.

Different investments pay out at different times – some monthly, some quarterly (every three months), and others annually. If you want strictly monthly income, you’ll need to choose investments specifically designed to pay out monthly or create a portfolio of different investments that pay out at different times throughout the year.

Why People Choose Monthly Income Investments

Monthly income investments are popular for several reasons. They can help you:

- Add to your regular salary income

- Create a steady income stream during retirement

- Build financial security with regular payments

- Have money available for regular expenses and bills

- Grow your wealth over time while enjoying some of the benefits now

Low-Risk Monthly Income Options

If you prefer safer investments with less chance of losing your money, these options might be right for you.

High-Yield Savings Accounts

Some UK banks and financial institutions offer high-interest savings accounts that pay interest monthly. While the returns are generally lower than other investment types, they offer very low risk and your money is usually protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. These accounts are easy to open and access, making them ideal for beginners or those with a low risk tolerance.

Government Bonds (Gilts)

UK government bonds, also known as gilts, are considered low-risk investments. When you buy a government bond, you’re essentially lending money to the government. In return, they pay you interest, often on a regular basis. Some gilts pay regular interest. This makes them a good choice for people who want steady monthly income with low risk.

Income Funds in ISAs

Individual Savings Accounts (ISAs) offer tax-free income, making them an attractive option for monthly income seekers. By investing in income funds through an ISA, all the income you receive is tax-free, which can significantly increase your returns.

The M&G Corporate Bond Fund is an example of an income fund that invests primarily in investment-grade bonds issued by companies. This fund pays distributions quarterly (in January, April, July, and October) and currently offers a historic distribution yield of 4.49%.

For those seeking monthly distributions, the Ninety One Diversified Income Fund offers a one-stop solution. This fund invests in a mix of bonds, dividend-paying shares, infrastructure, and property to deliver reliable income with potential for capital growth. It currently provides a distribution yield of 5.06% with monthly payments.

Medium-Risk Monthly Income Options

These investments carry moderate risk but may offer better returns than low-risk options.

Corporate Bonds

Corporate bonds work like loans to companies instead of governments. Companies issue bonds and pay regular interest to investors who buy them. These interest payments often come monthly. High-yield corporate bonds offer better returns but come with higher risks of the company defaulting. Blue-chip company bonds (from large, established companies) usually provide a good balance between risk and reward.

Dividend-Paying Stocks

Some UK companies pay dividends to shareholders on a monthly or quarterly basis. By investing in well-established firms with strong cash flow, you can ensure a more consistent income. The Morningstar UK Dividend Yield Focus Index tracks high-quality, dividend-paying stocks in the UK and has risen 9.8% over the past year.

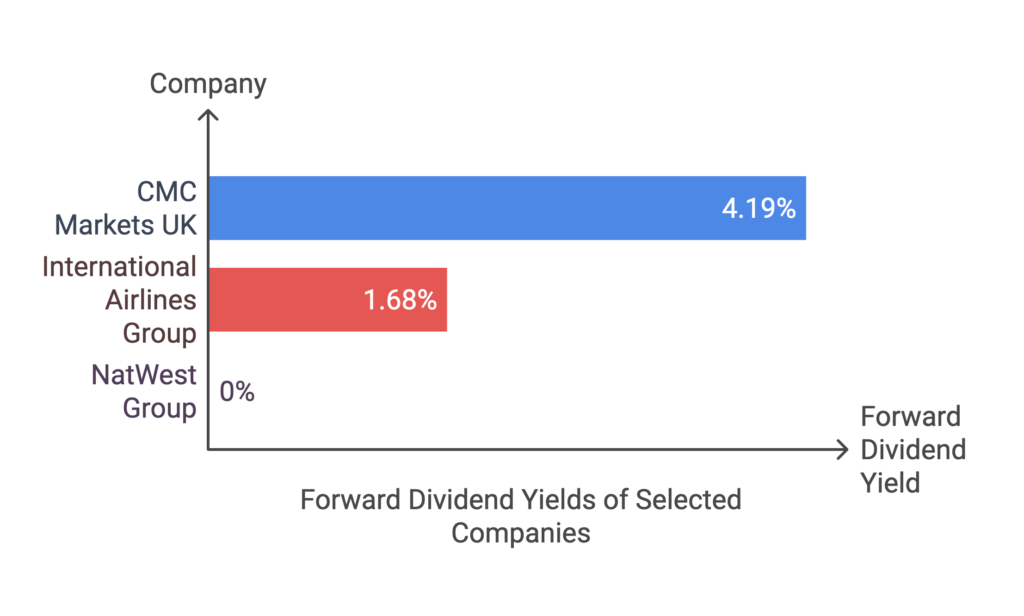

Some top-performing dividend stocks in 2024 include:

- CMC Markets UK, with a forward dividend yield of 4.19%

- International Airlines Group, with a forward dividend yield of 1.68%

- NatWest Group

Real Estate Investment Trusts (REITs)

REITs are companies that own and manage income-generating properties. What makes them special is that they must give at least 90% of their profits to shareholders. This leads to regular and often large dividend payments. Many UK REITs focus on commercial properties, shopping centers, office buildings, or residential apartments.

REITs let you invest in real estate without buying physical properties. This makes them easier to access than direct property investment. They’re traded on stock exchanges like regular shares, so you can buy and sell them easily.

Higher-Risk Monthly Income Options

These investments typically offer higher potential returns but come with increased risk.

Peer-to-Peer (P2P) Lending

P2P lending platforms connect investors directly with individuals or businesses looking to borrow money. As an investor, you earn interest on the money you lend, often paid monthly. Returns can be attractive, but there’s always the risk that borrowers might default on their loans.

P2P lending platforms typically allow you to spread your investment across multiple loans to reduce risk. Some platforms also have contingency funds to protect investors from defaults. However, unlike bank savings, P2P investments are not covered by the FSCS, so you could lose money if borrowers don’t repay.

Buy-to-Let Property

Investing in rental property provides monthly rental income from tenants. This traditional form of investment continues to be popular in the UK, with the average gross rental yield currently standing at 5.60%.

According to Baron & Cabot, UK property values have increased by 464% over the last 50 years, with current rental yields averaging 4.71%. This suggests potential for both regular income and long-term capital growth.

To maximize returns from buy-to-let property, look for locations with high tenant demand and strong rental yields. Consider using property management services to make this a more passive investment, although this will reduce your income due to management fees.

High-Yield Dividend Stocks

Some companies offer particularly high dividend yields, but these often come with increased risk. For example, CMC Markets UK saw impressive growth of 146.1% in 2024 and offers a forward dividend yield of 4.19%.

These high-yield stocks can give you good monthly or quarterly income. However, their prices may change more than those of stable dividend stocks. There is also no guarantee that high dividends will keep coming in the future.

How to Choose the Right Investment

Selecting the right monthly income investments depends on several factors:

Assess Your Financial Goals

Think about why you want monthly income. Is it to supplement your current earnings, prepare for retirement, or create passive income? Different goals might require different investment approaches. For example, if you’re young and saving for the long term, you might accept more risk for higher potential returns. If you’re near retirement, you might prefer safer investments that preserve your capital.

Understand Your Risk Tolerance

How comfortable are you with the possibility of losing some of your investment? Low-risk investments like savings accounts and government bonds offer more security but lower returns. Higher-risk investments like P2P lending and certain stocks might provide better returns but with greater risk to your capital.

Be honest with yourself about how you would feel if your investments dropped in value. If the thought keeps you up at night, stick to lower-risk options.

Consider Diversification

Instead of putting all your money into one type of investment, consider spreading it across different options. This strategy, called diversification, can help reduce risk and smooth out your returns. The Ninety One Diversified Income Fund invests in a mix of bonds, dividend-paying stocks, infrastructure, and property. This mix provides built-in diversification.

You could create your own diversified portfolio by investing in several different types of monthly income investments, such as some savings accounts, some corporate bonds, and perhaps some dividend-paying stocks or REITs.

Start Small and Learn

If you’re new to investing, it’s often wise to start with smaller amounts in safer investments. As you gain confidence and knowledge, you can gradually explore options with higher potential returns. Educational resources from financial institutions, independent financial advisors, or investment platforms can help you make more informed decisions.

Conclusion

The UK offers various investment options for generating monthly income, suited to different risk appetites and financial goals. From safer options like high-yield savings accounts and government bonds to medium-risk investments like corporate bonds and REITs, and higher-risk options like P2P lending and buy-to-let property, there’s something for every investor.

Remember that higher returns typically come with higher risks, so it’s important to understand your own risk tolerance and financial goals before investing. Diversification across different types of investments can help manage risk while still providing regular monthly income.

Consider seeking professional financial advice if you’re unsure about which investments are right for your situation. With careful planning and research, you can build an investment portfolio. This portfolio can give you regular monthly income. It can also help you reach your long-term financial goals.

FAQ: Key Considerations for Monthly Income Investments and Risk Assessment in the UK

- What are the best dividend-paying stocks for monthly income in the UK?

- Companies like Real Estate Investment Trusts (REITs), FTSE 100 stocks such as National Grid, Legal & General, and Imperial Brands are often favored for their consistent monthly dividends.

- How do REITs compare to other monthly income investments in the UK?

- REITs offer relatively high yields due to rental income from real estate assets. REITs can offer higher income than stocks or bonds. However, they may be more volatile based on property market conditions.

- What are the risks associated with high-yield corporate bonds?

- High-yield corporate bonds have a higher risk of default, interest rate risk, and credit risk. This is because the companies that issue them may be financially weaker.

- How can I assess the creditworthiness of companies issuing bonds?

- You can check creditworthiness by looking at credit ratings from agencies like Moody’s and S&P. You should also analyze the company’s financial statements, debt-to-equity ratio, and cash flow stability.

- What factors should I consider when choosing a P2P lending platform?

- When choosing a P2P lending platform, consider a few important factors. Look at the default rates. Check the interest rates. Be aware of the platform fees. Review the credit ratings of borrowers. Finally, ensure the platform security is strong. This will help you match your risk tolerance and investment goals.