Selling shares online may seem daunting, especially if you’re new to online share trading, but it doesn’t have to be. This guide will help you step-by-step. It covers choosing the right online broker and placing your sell order. You will find everything you need to get started.

Online share trading has revolutionized how we buy and sell stocks, providing the flexibility to trade from virtually anywhere. To begin, you’ll need to choose an online trading platform that connects you to the stock market. These platforms provide real-time data and tools that allow you to make informed decisions about your investments.

In this guide, we’ll cover the basics of online trading. You’ll learn about different order types, pricing strategies, and how to use your trading platform. We will also look at when to sell your shares and how to price them. We will discuss what happens after the sale, like settlement, taxes, and reinvestment. Let’s dive in!

Here’s a brief overview of key elements in online share trading:

- Brokerage Account: A crucial gateway to buying and selling shares.

- Trading Platforms: Offer tools and real-time market access.

- Sell Orders: Different types of orders determine how and when you sell.

- Market Research: Involves tracking trends and analyzing data.

- Security Measures: Protect your investments from potential risks.

Benefits of Selling Shares Online

Selling shares online has numerous advantages. One of the biggest perks is convenience. You can manage your investments without leaving home.

Another significant benefit is speed. Online transactions are processed quickly, unlike traditional methods. This allows you to respond swiftly to market changes.

Real-time market data access is another boon. Online platforms provide up-to-the-minute updates. This ensures that your decisions are based on the latest available information.

What is a Brokerage Account?

A brokerage account is your entry ticket to the world of trading stocks online. It is necessary for buying and selling shares through a broker. This account is where your funds are held for trading.

Opening a brokerage account is a simple process. It involves choosing a broker and completing the necessary paperwork. Understanding the fees involved is also key to managing costs effectively.

Through your brokerage account, you will access various trading tools and resources. It’s essential to select a broker that aligns with your trading needs. This ensures a seamless and efficient trading experience.

Choosing the Right Online Broker

Choosing the right online broker is a pivotal step in your trading journey. There are numerous brokers available, each offering different services and features. It’s crucial to select one that fits your trading style and goals.

When evaluating brokers, consider several factors. Look into the range of financial instruments they offer and the ease of platform use. Customer support and educational resources should also be on your checklist.

|

Trusted Partner

|

Best for Beginners

|

Top Pick

|

|

Our Rating:

4.7

|

Our Rating:

4.9

|

Our Rating:

4.9

|

|

|

|

- Regulation and Licenses: UK (FCA), Cyprus (CySEC), Seychelles (FSC), South Africa (FSCA), Curaçao (CBCS), BVI (FSC)

- Trading Platforms: MT4, MT5

- Leverage: Up to 1:2000

- Minimum Deposit: $10

- Fees: No commissions, spreads from 0.2 pips

- Regulation and Licenses: New Zealand (FSP), Seychelles (FSA), UK

- Trading Platforms: MT4, MT5, cTrader, TradingView, BlackBull CopyTrader, BlackBull Invest

- Leverage: Up to 1:500

- Minimum Deposit: Starting from $0

- Fees: No commissions (For standard accounts)

- Regulation and Licenses: Europe, Australia, Japan, British Virgin Islands, South Africa, Ireland

- Trading Platforms: MT4, MT5, AvaTradeGO App, ZuluTrade, Web-trader

- Leverage: Up to 1:400

- Minimum Deposit: $100

- Fees: No commissions on most trades.

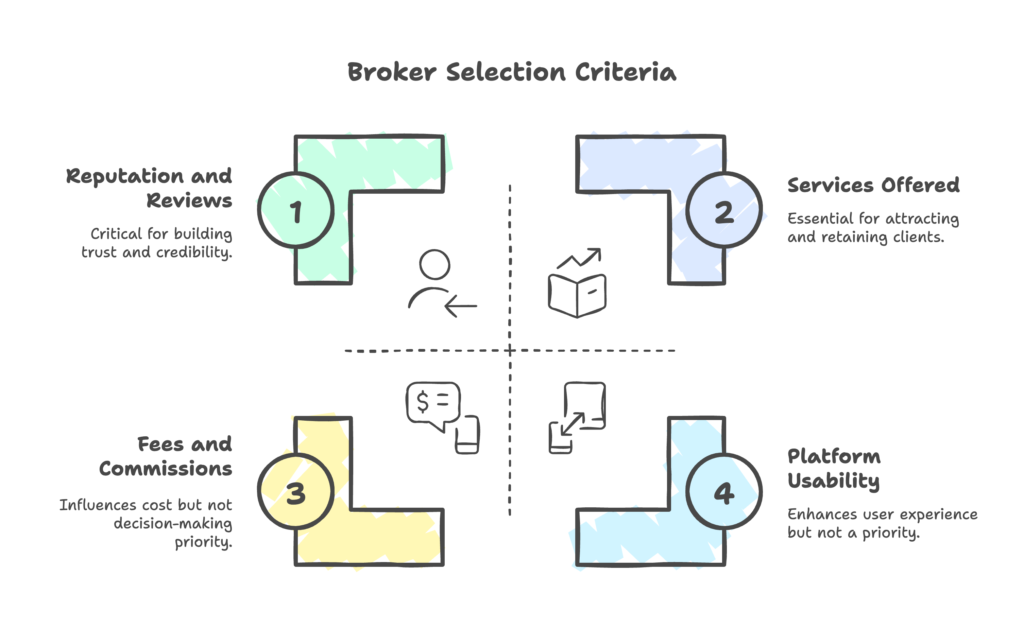

Below are key considerations when selecting a broker:

- Services Offered: Types of accounts, research tools, and trading features.

- Fees and Commissions: Transaction fees, inactivity fees, and account maintenance.

- Reputation and Reviews: Broker reliability and user feedback.

- Platform Usability: Interface design and mobile compatibility.

- Support Services: Availability of customer service and educational materials.

Comparing Broker Services and Fees

Different brokers offer various services, from access to different markets to in-depth research tools. Assess what each broker provides beyond basic trading services. Make sure their offerings align with your investment strategy.

Fees and commissions can vary significantly among brokers. While some may offer low fees, they might compromise on features or support. Balance your need for lower costs with access to valuable resources and tools. Analyzing this trade-off is crucial to maximizing your returns.

Opening Your Brokerage Account

Once you’ve chosen your broker, the next step is opening your brokerage account. This typically involves filling out an online application form. You will need to provide personal identification and financial information.

During this process, it’s essential to understand the terms and conditions. Review any fees associated with the account setup and ongoing maintenance. Knowing these details will help you avoid surprises later.

After setting up your account, you’ll have access to the trading platform and tools. Familiarizing yourself with these resources will empower you to make informed trading decisions. This preparation lays a solid foundation for your online share trading journey.

Navigating the Brokerage Platform

Once your brokerage account is active, the next step is to navigate the platform. Familiarizing yourself with the platform’s layout is crucial for efficient trading. This will help you access the tools and features you need.

Spend some time exploring the dashboard to understand its functionalities. Look for key sections like your portfolio, watchlist, and trading interface. These areas will provide valuable data and insights for trading.

Interactive tutorials or guides offered by the broker can be a significant help. They can show you how to execute trades and use analytical tools. Taking advantage of these resources will increase your confidence and efficiency in trading stocks online.

Understanding the Trading Interface

Understanding the trading interface is key to executing trades efficiently. This area allows you to place buy or sell orders, view market data, and more. A well-designed interface is intuitive and makes the trading process seamless.

Spend time getting to know the features offered on the interface. You’ll find options such as charts, indicators, and various order types. Learning how to interpret these can greatly enhance your trading strategy.

Setting Up a Watchlist

Setting up a watchlist is a beneficial feature for monitoring your stocks. This tool lets you track the performance of selected shares in real-time. By keeping an eye on these, you can make timely decisions about your investments.

How to Place a Sell Order Online

Placing a sell order online is a straightforward process once you’re familiar with the platform. Begin by navigating to the trading interface on your broker’s site. Look for the option to place a trade, which will usually lead to various buy and sell options.

Next, you’ll need to enter the details of the sell order. This includes the number of shares you wish to sell and the order type. Ensure you’re comfortable with these details, as they dictate how and when your shares sell.

Before finalizing the order, review all the specifics you’ve entered. This includes checking the stock symbol, the shares’ quantity, and the order type. Once everything is verified, you can place the order with the click of a button.

After submitting the order, monitor your account to ensure the transaction completes. The system should update once the sale finalizes, and you should receive a trade confirmation message. This is your cue to check how the proceeds are reflected in your balance.

Types of Sell Orders

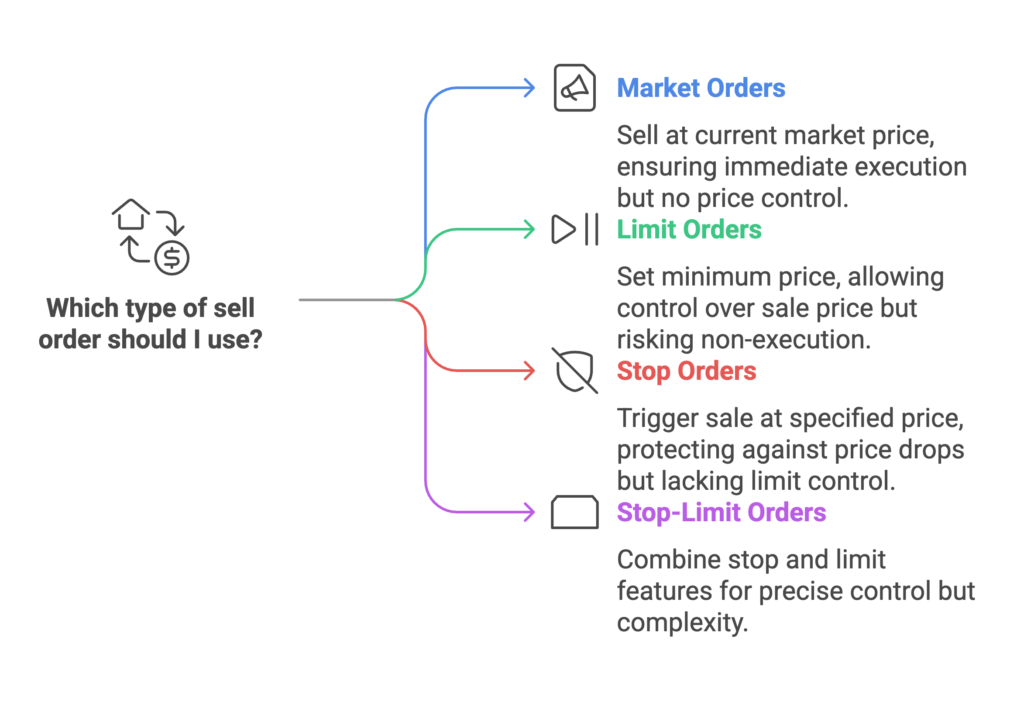

Understanding different types of sell orders is crucial for maximizing your trading strategy. Each order type serves a specific purpose and is suitable for varied market conditions. Familiarity with these options gives you more control over how you execute trades.

Here are the main types of sell orders:

- Market Orders: Sell shares at the current market price.

- Limit Orders: Set a specific minimum price for selling shares.

- Stop Orders: Trigger a sale when a specified price is reached.

- Stop-Limit Orders: Combine features of stop and limit orders for precise control.

Market Orders

Market orders are the simplest order type you can use. They instruct the broker to sell your shares at the current market price. This order type prioritizes speed over price.Limit Orders

Limit orders allow you to sell shares at a predetermined price. You set the minimum price at which you’re willing to sell your shares. This helps ensure you do not accept a lower price than desired.Stop Orders and Stop-Limit Orders

Stop orders activate a sell order once the stock reaches a specified price. With stop-limit orders, the sale occurs only if the stock reaches that price and can also meet your limit price criteria. This combination helps protect against significant losses while allowing for strategic selling.

Timing and Pricing Your Share Sale

When selling shares, timing and pricing are crucial. Both significantly impact your potential profits. An effective strategy considers the current market conditions and your personal financial goals.

Market trends often dictate share prices, influencing when and how to sell. A well-informed approach involves monitoring these trends carefully. By doing so, you can align your selling strategy with favorable conditions.

Additionally, your pricing strategy should reflect your desired outcomes. It’s essential to set realistic expectations for your sale. Understanding the market climate helps refine your approach, making educated decisions on when to sell your shares.

Market Conditions and Pricing Strategies

Market conditions can change rapidly, affecting your selling choices. Knowing when the market is volatile or stable is advantageous. In volatile markets, prices fluctuate rapidly, creating opportunities for strategic sales.

Your pricing strategy should align with these conditions. Consider using limit orders to set a desired selling price in fluctuating markets. This ensures you achieve a minimum acceptable return, even if the price swings dramatically.

The Role of Timing in Selling Shares

Timing is a crucial factor when it comes to selling shares. Selling at the right moment can maximize your returns. Observing market indicators and economic reports helps in determining the optimal selling window.

However, timing isn’t solely about watching the market. Personal financial goals play a role in your timing decisions too. Whether you’re seeking short-term gains or long-term stability, your sell decisions should complement these objectives. Balancing both market timing and personal goals can lead to more successful outcomes in share sales.

After the Sale: Settlement, Taxes, and Reinvestment

Once your shares are sold, the process doesn’t end there. It’s important to understand what follows the sale. This ensures you’re prepared for the next steps after trading stocks online.

The settlement period is a key aspect. It affects when the funds become available to you. Being aware of this timeline is crucial for planning your finances post-sale.

Taxes also play a significant role in selling shares. Keeping accurate records of your transactions is essential. This ensures compliance and helps in calculating your tax obligations correctly.

Finally, consider how you plan to use your proceeds. Reinvestment might be an option to grow your wealth further. Exploring opportunities like buying other stocks or financial products can be beneficial.

Understanding the Settlement Period

The settlement period refers to the time between selling shares and receiving funds. Typically, this period lasts two to three business days. Knowing this timeframe helps manage your liquidity expectations after a sale.

During the settlement period, the transfer of shares and funds is finalized. It’s crucial to factor this delay into your financial plans. Being prepared enables you to utilize your funds effectively once they are released.

Tax Implications and Record Keeping

Selling shares often involves tax considerations. Capital gains tax applies to profits made from share sales. Understanding these tax implications is vital for financial planning.

Keeping detailed records of your transactions is essential. Documentation should include purchase and sale dates, prices, and related costs. This information is vital during tax filings and can assist in avoiding potential audit issues.

Reinvesting Your Proceeds

Reinvesting the proceeds from your share sale can be a strategic move. Consider using the funds to purchase other stocks, ETFs, or mutual funds. Reinvestment can help diversify your portfolio and potentially increase future returns.

It’s important to align reinvestment with your overall investment strategy. Assess your financial goals and risk tolerance when choosing new investments. By doing so, you maintain a balanced and resilient investment portfolio.

Risks and Security in Online Share Trading

Trading stocks online offers many benefits, but it also presents risks. Being aware of these risks is essential for protecting your investments. Understanding the potential pitfalls can help you develop strategies to navigate them wisely.

One significant risk is market volatility, which can lead to unexpected losses. Additionally, cybersecurity threats pose a danger to your online brokerage account. Ensuring robust security measures are in place can safeguard your assets.

Education is key to managing these risks effectively. Staying informed about market changes and using technical analysis tools can aid decision-making. Knowledge equips you to handle challenges and secure your investments.

Mitigating Risks and Protecting Your Account

To mitigate risks, diversify your investment portfolio. This approach reduces the impact of any single asset’s poor performance. Diversification helps balance potential gains and losses across different sectors.

Protecting your online brokerage account is crucial. Use strong, unique passwords and enable two-factor authentication. Regularly monitor your account for suspicious activity to prevent unauthorized access and loss of funds.

Regulatory Bodies and Investor Protection

Regulatory bodies play a vital role in safeguarding investors. Organizations like the SEC in the U.S. enforce regulations to maintain market integrity. They provide a framework to ensure fair trading practices and investor protection.

Investors benefit from understanding these regulations. Familiarize yourself with the rules governing online share trading. This knowledge helps you comply and secure your rights as an investor, providing peace of mind in your trading activities.

Common Mistakes and Best Practices

Navigating the world of online share trading can be tricky. Many investors, especially beginners, make common errors that can be costly. Learning about these mistakes helps in avoiding them and improving trading outcomes.

A primary mistake is neglecting to research thoroughly before selling shares. Without understanding the market, investors might make poor decisions. Additionally, overreliance on tips or speculation can lead to significant financial losses.

To enhance your trading experience, follow best practices such as:

- Regularly review your portfolio for necessary adjustments.

- Use demo accounts to practice without financial risk.

- Maintain diversified investments to manage risks effectively.

By adopting these best practices, you can develop disciplined trading habits and boost your overall performance.

Avoiding Emotional Trading and Overtrading

Emotions often influence investors, leading to hasty decisions. Emotional trading, driven by fear or greed, can impact your investments negatively. Remaining calm and sticking to your plan is crucial during market fluctuations.

Overtrading is another pitfall, where frequent buying and selling erodes profits. Traders often overlook transaction costs, which can quickly add up. Focus on quality trades rather than quantity to maximize potential gains.

The Importance of a Clear Investment Strategy

A clear investment strategy is essential for successful share trading. Without a defined plan, investors are more likely to be swayed by market noise. A strategy guides decision-making and helps maintain focus on financial goals.

Before selling shares, analyze your investment objectives. Consider factors like risk tolerance, time horizon, and desired returns. Developing a strategy tailored to these elements ensures that your decisions are aligned with your long-term plans.

Conclusion and Next Steps

Selling shares online can be a rewarding endeavor with the right approach. By understanding the process, you empower yourself to make informed decisions. Confidence grows with knowledge, enabling better trading outcomes.

As you refine your strategy, remember that the markets are constantly evolving. Stay proactive in your learning to remain adaptive and resilient. This ensures that your investment activities align with changing market dynamics and personal goals.

Selling Shares Online: Continuous Learning and Adapting Strategies

The world of selling shares online is ever-changing. To stay ahead, commit to continuous learning about new tools and strategies. This keeps your skills sharp and helps you adapt to shifting market conditions.

Be open to adjusting your strategy as you gain experience. Real-time analysis and feedback from your trades can inform future decisions. Embrace a mindset of growth and experimentation to keep your portfolio responsive to change.

Staying Informed and Updated

Keeping abreast of market news is essential for informed trading decisions. Regularly monitor economic indicators and company reports that impact stock prices. This vigilance helps you anticipate market trends and respond accordingly.

Using resources like financial news websites and market analysis tools enhances your understanding of the trading landscape. Staying updated ensures that you can swiftly act on opportunities and protect your investments during volatile times—key components of success when selling shares online..