Investing can be a daunting task. Especially when you’re looking for safe investments in the UK that offer high returns.

But what does ‘safe’ really mean in the context of investments?

It refers to investments that carry low risk. These are typically assets that are less likely to lose value. They provide steady, reliable returns over time.

In the UK, there are numerous safe investment options. These range from government bonds to high-interest savings accounts.

This article will guide you through these options. It will help you understand the balance between risk and return.

By the end, you’ll be equipped to make informed decisions about safe investments with high returns in the UK. Let’s dive in.

Understanding Safe Investments in the UK

Investing is as much about risk management as it is about returns. Safe investments in the UK are those that offer lower risk and steady growth. They are ideal for conservative investors who wish to preserve capital.

Government bonds, high-interest savings accounts, and National Savings and Investments (NS&I) products are classic examples. These investments are considered secure due to their stability and relative immunity to market volatility.

Many investors overlook safe investments because they believe they offer minimal growth. However, with strategic choices, it’s possible to earn significant returns over time.

It’s crucial to understand the balance between safety and gains. Safe investments help protect your assets during economic downturns. This is essential for long-term financial stability.

A diversified portfolio that includes both safe and riskier investments is usually the wisest choice. This approach helps in maximizing returns while minimizing potential losses.

The Balance Between Risk and Return

Investments balance risk and reward. Low-risk investments often yield consistent, albeit modest, returns. They are predictable and reduce the chance of losing principal.

Riskier options may offer higher returns. However, they come with greater potential for loss. Balancing these two elements is crucial for a well-rounded portfolio.

Understanding your risk tolerance is key. This helps in choosing the right combination of investments that suit your financial goals.

The UK’s Economic Stability and Investment Environment

The UK offers a stable economic backdrop for safe investments. Its established financial markets and regulatory frameworks ensure investor protection. This stability supports various low-risk investment options.

The Financial Services Compensation Scheme (FSCS) in the UK safeguards certain investments. It assures investors of compensation if financial institutions fail.

The UK government’s strong financial position reinforces confidence. This environment promotes secure and reliable investment opportunities, making the UK an attractive location for risk-averse investors.

Traditional Safe Investments in the UK

Traditional safe investments are the cornerstone of many UK portfolios. These investment options offer stability and security, making them ideal for risk-averse investors. They typically include government bonds, NS&I products, and high-interest savings accounts.

These investments provide a reliable way to preserve capital. Though the returns might not be as high as riskier options, they offer peace of mind. For many, this security outweighs the allure of higher gains elsewhere.

The returns from these investments may also outpace inflation, particularly in the long run. They are a solid choice for those preparing for future expenses, like retirement or education.

Diversifying within this safe category is also advisable. By including a mix of these options, investors can balance risk and enhance growth potential. Traditional safe investments remain a practical choice for cautious investors focused on long-term financial health.

Government Bonds (Gilts)

Government bonds, also known as gilts, are a traditional staple in the UK. They are issued by the government, ensuring a high level of safety. Investors receive a fixed interest rate, making returns predictable.

These bonds are used to fund public expenditures. The stability they offer appeals to conservative investors. Even during economic instability, gilts tend to hold their value.

Over the years, gilts have delivered reliable returns. This makes them a go-to option for safeguarding capital, especially in uncertain times.

National Savings and Investments (NS&I) Products

NS&I products provide a government-backed investment choice. They offer exceptional security, being directly backed by the UK Treasury. Popular options include premium bonds and income bonds.

Premium bonds are unique; they offer tax-free prizes instead of interest. This aspect makes them attractive to many investors. However, returns are not guaranteed.

Income bonds offer monthly interest payments and easy access to funds. They are a straightforward option for investors seeking regular income with minimal risk.

High-Interest Savings Accounts

High-interest savings accounts offer liquidity and ease of access. They are a simple way to earn interest without locking away funds. These accounts are ideal for emergency funds or short-term savings goals.

The interest rates can be competitive, though they vary between providers. Some accounts offer bonus rates or introductory offers, enhancing returns.

FDIC protection for savings accounts in the UK ensures safety. This makes them a preferred choice for low-risk investments, especially for cautious individuals.

Cash ISAs and Fixed-Rate Bonds

Cash ISAs offer a tax-free way to save. The interest earned is not subject to income tax, maximizing returns. They are highly flexible, allowing for annual deposits up to a set limit.

Fixed-rate bonds are another secure option. They require locking in funds for a specified term but offer higher interest rates. This makes them attractive for those who can commit to longer-term investments.

Both options provide a degree of predictability. This makes them appealing to those seeking to preserve wealth while earning steady returns.

Emerging Low-Risk High-Reward Investments

Emerging investment opportunities present exciting potential for high returns. These options cater to those willing to venture beyond traditional paths without taking on excessive risk.

One such option is peer-to-peer lending, which connects borrowers and investors directly. This approach often results in higher interest rates than conventional savings. It’s an innovative way to diversify while still considering risk levels.

Real Estate Investment Trusts, or REITs, offer another appealing avenue. They provide exposure to the property market, minus the need to buy property. Their structure allows investors to benefit from rental income and property appreciation.

These newer investment methods balance innovation with caution, making them worthwhile for those seeking higher returns. It’s essential to understand their mechanisms and risks, ensuring alignment with financial goals. As with any investment, due diligence can help in navigating these opportunities effectively.

Peer-to-Peer Lending

Peer-to-peer lending offers investors a direct link to borrowers. Platforms facilitate these connections, potentially offering higher returns than banks. For investors, it represents a unique chance to diversify outside of traditional avenues.

The returns are higher due to reduced overheads associated with banks. However, it’s vital to assess borrower risk, as default risks can impact returns.

Thorough research on platform credibility and borrower ratings is crucial. Many platforms provide detailed information, aiding investors in making informed choices. This direct lending approach can be a compelling addition for those seeking to blend innovation with risk management.

Real Estate Investment Trusts (REITs)

REITs allow investors access to the property market without owning physical real estate. They pool capital to invest in property portfolios, generating returns through rent and property value appreciation. This setup can enhance portfolio diversity and income stability.

REITs are traded on stock exchanges, offering liquidity and ease of access. Unlike direct property investment, they require lower initial capital, making them accessible to a broader audience.

The potential for regular dividend payouts is another attractor. However, like all investments, REITs carry market risks. It’s advisable to examine the specific focus and performance history of any REIT before investing.

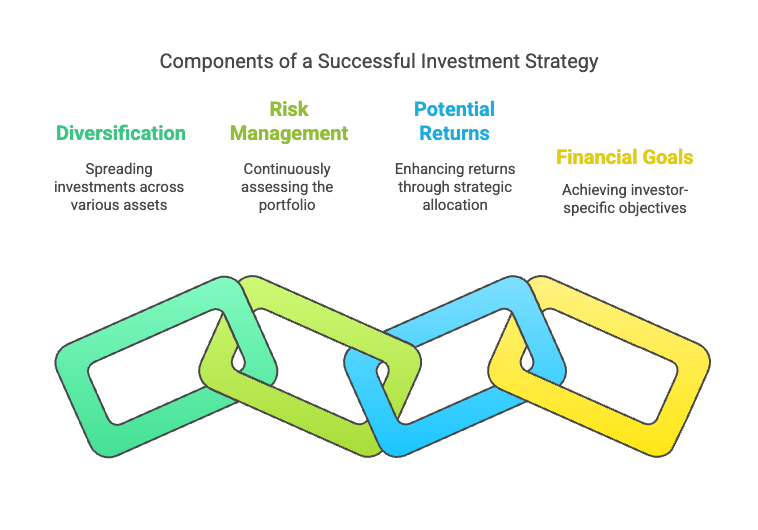

Diversification and Risk Management

Diversification is the cornerstone of a robust investment strategy. By spreading investments across various assets, risk is mitigated. This approach lowers the impact of poor performance in any single investment.

The benefits of diversification extend beyond risk reduction. It enhances potential returns by capturing gains across multiple sectors. The goal is to create a balance between risk and reward.

Effective risk management goes hand in hand with diversification. It’s crucial to continuously assess and adjust the portfolio’s composition. This ongoing process ensures alignment with financial goals and market conditions.

Incorporating a mix of asset types can offer stability, especially in volatile markets. The right diversification strategy depends on individual risk tolerance and investment objectives. Clear understanding and thoughtful execution are key to successful risk management.

The Importance of Diversification

Diversification is vital for protecting against market volatility. It involves investing in a variety of asset classes, such as stocks, bonds, and real estate. This approach reduces the likelihood of significant losses.

Each asset class reacts differently to market changes. A diversified portfolio stands a better chance of withstanding downturns. This mix of investments maximizes return potential while minimizing overall risk.

By diversifying, investors avoid putting all their eggs in one basket. It ensures a more balanced and resilient investment strategy. Ultimately, it can result in steadier growth over the long term.

Assessing Risk Profiles and Time Horizons

Understanding your risk profile is essential for investment success. It reflects your comfort level with potential losses and gains. A proper assessment helps in selecting suitable investments.

Your investment time horizon plays a significant role in decision-making. A long-term horizon often allows for more aggressive investments. Conversely, a shorter horizon demands a cautious, risk-averse approach.

Aligning investment choices with both risk tolerance and time horizon is crucial. It ensures a strategy that fits your financial objectives and life stage. Regular reassessment keeps your investments aligned with any changes in your situation.

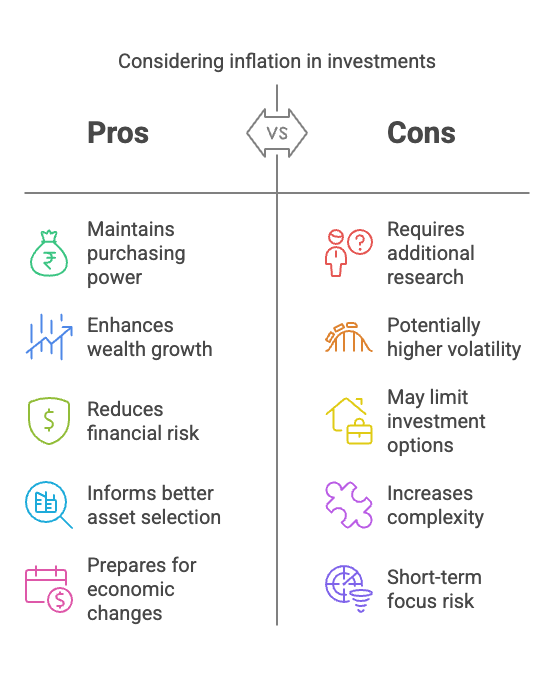

The Role of Inflation and Compound Interest

Inflation is a silent eroder of purchasing power. It reduces the value of money over time. For investors, it’s crucial to consider inflation when evaluating returns. Inflation-adjusted returns offer a more accurate picture of actual earnings.

On the flip side, compound interest can significantly boost investment growth. It is the process of earning returns on both initial capital and accumulated interest. Over time, compounding can exponentially increase investment value.

For long-term goals, understanding these factors is vital. Ignoring inflation could lead to underestimating the required growth for meeting future needs. Conversely, leveraging compound interest can optimize wealth accumulation.

A balanced approach considers both inflation and compound interest. This mindset helps in crafting an investment strategy that maximizes gains while protecting against inflation. Continuous monitoring of these elements is essential for staying on track.

Inflation’s Impact on Investments

Inflation can diminish real returns on investments. As prices rise, the purchasing power of fixed returns declines. Investors should factor in inflation when assessing potential gains.

Many safe investments offer relatively fixed returns. Inflation erodes the real value of these returns over time. Even low-inflation environments affect the real growth of savings and investments.

Mitigating the impact of inflation requires proactive planning. Choosing investments that outpace inflation is key. This approach preserves the purchasing power of money in a portfolio.

The Power of Compound Interest

Compound interest can transform investments into substantial wealth over time. It’s the reinvestment of earnings that accelerates growth. The longer the time period, the more profound the effect.

To harness compound interest, consistency is important. Regular contributions enhance the overall investment pool. This accumulation magnifies the benefits of compounding.

Selecting investments with attractive returns can maximize compounding effects. Regular monitoring and reinvestment strategies are crucial. Over the long term, small initial investments can yield significant returns through the power of compounding.

Tools and Resources for Safe Investing

Investing wisely in the UK requires utilizing available tools and resources. These can guide informed decisions and optimize returns. Two key tools include robo-advisors and financial planners, each with unique benefits.

Robo-advisors use technology to manage investments automatically. They’re accessible and cost-effective for tech-savvy investors. These platforms are ideal for those seeking low-cost portfolio management.

Financial planners, on the other hand, offer personalized advice. They provide guidance tailored to individual goals and risk profiles. Their expertise can be especially useful for complex financial situations.

Understanding fees, charges, and tax implications is vital. These factors significantly impact net investment returns. Being informed helps avoid unexpected costs and enhances overall financial planning.

Robo-Advisors and Financial Planners

Robo-advisors offer automated, algorithm-driven investment services. They’re an affordable choice for beginners and those with straightforward portfolios. Robo-advisors typically charge lower fees than traditional advisors.

Financial planners provide human touch and personalized advice. They can address complex financial scenarios. This approach suits those needing comprehensive planning, especially during major life events.

Choosing between a robo-advisor and a financial planner depends on individual needs. Those comfortable with digital platforms might prefer robo-advisors. Individuals seeking tailored advice might benefit more from a personal planner.

Understanding Fees, Charges, and Tax Implications

Understanding fees and charges is crucial in investing. They can drastically affect net returns. This includes management fees, transaction fees, and account fees.

Taxes also play a major role in investment outcomes. Various investments are taxed differently. Capital gains, dividends, and interest may be subject to taxes, impacting net returns.

Investors should be proactive in understanding these expenses. This knowledge allows for better financial planning and ensures more efficient investing. Choosing tax-efficient accounts, like ISAs, can also help optimize returns.

Conclusion: Making Informed Investment Decisions

Making informed investment decisions is crucial for financial success. It requires a mix of knowledge, strategy, and careful planning. Investors need to assess their goals and risk tolerance before choosing investment vehicles.

An investor’s journey often involves learning and adaptation. The economic landscape changes, and investors must remain flexible. Being informed allows for adjustments in strategy as conditions evolve.

In the UK, numerous investment options exist to balance safety and returns. By leveraging resources and staying informed, investors can confidently pursue financial growth.

The Importance of Financial Education and Patience

Financial education empowers investors to make wise choices. Understanding market dynamics and investment products is essential. Education reduces anxiety and enhances decision-making capabilities.

Patience is equally vital in the investment process. Markets can be volatile, testing investor resolve. Patience helps in riding out the highs and lows with composure.

Combining education and patience builds investor confidence. Both are fundamental to navigating the complexities of safe investments in the UK. Together, they foster informed and consistent decision-making.

Regular Review and Rebalancing of Your Portfolio

Regular portfolio reviews keep investments aligned with goals. Market conditions and personal circumstances can change over time. Investors should frequently assess their portfolio’s performance.

Rebalancing is a key part of portfolio management. It involves adjusting asset allocations to maintain desired risk levels. This ensures that an investor’s portfolio remains in line with their strategy.

Ignoring regular reviews and rebalancing can lead to unintended risk exposure. By staying proactive, investors can ensure their portfolio remains optimized. This ongoing process is vital for achieving long-term financial objectives.