A stocks shares ISA is a tax-advantaged way to invest in stocks, funds, and other securities. It offers a protective shield against taxation on profits and dividends.

Every UK resident over 18 can open one, allowing investments to grow tax-free within the annual ISA allowance. This can boost long-term wealth by reducing tax liabilities.

You need to know the different types of ISAs. There are cash ISAs and stocks and shares ISAs. Stocks and shares ISAs offer more potential for growth. Unlike cash ISAs, these accounts can generate higher returns due to their exposure to the stock market. However, they also come with risk.

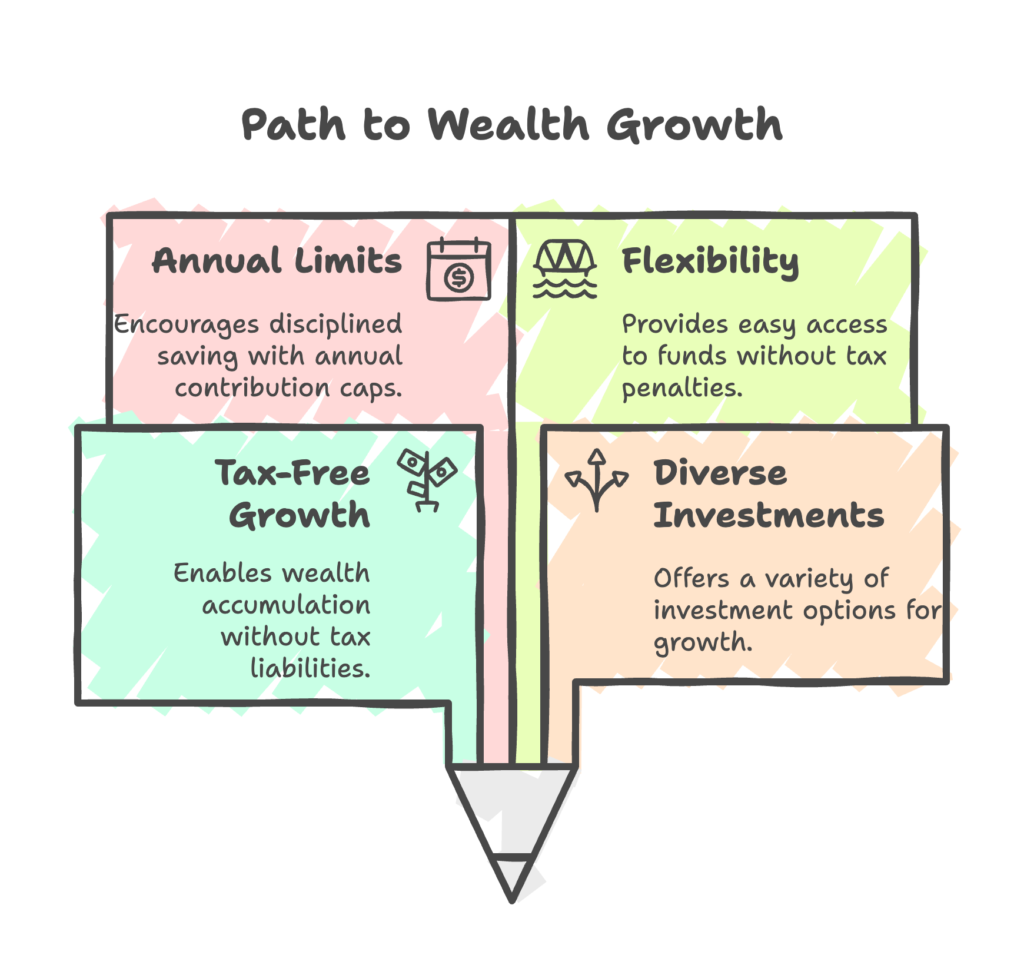

The annual tax-free allowance for ISAs, including stocks shares ISAs, is currently set by the UK government.

Key points about stocks shares ISAs include:

Understand these features to maximize benefits and manage investments effectively.

The Basics of a Stocks Shares ISA

A stocks shares ISA lets investors build a diversified portfolio. You can invest in individual stocks, managed funds, or ETFs. This variety ensures that you can tailor investments based on your financial goals and risk tolerance.

ISA stands for Individual Savings Account, distinct for its tax-free features. Unlike traditional savings accounts, stocks shares ISAs offer relief from both income tax on dividends and capital gains tax on profits. This makes them attractive for those seeking to maximize returns over time.

Nevertheless, understanding the implications of market volatility is crucial. Unlike a cash ISA, which offers stable returns, stocks shares ISAs are influenced by market fluctuations. Therefore, potential investors must assess their risk appetite.

An annual contribution cap applies, set by the government. If unused, it cannot be carried forward. This deadline prompts strategizing, like planning contributions early in the tax year.

While stocks shares ISAs have certain commonalities with other ISAs, the scope for higher returns makes them distinctive. Effective management involves routine review of the portfolio’s performance and rebalancing it periodically. This ensures alignment with your investment goals.

How Stocks Shares ISAs Work

Opening a stocks shares ISA involves selecting a provider, considering fees, services, and investment options. After choosing a provider, the application process can usually be completed online.

Once set up, you have the freedom to choose where to allocate your funds. Options include individual stocks and bonds, mutual funds, or ETFs. This versatility supports a strategy tailored to personal financial ambitions.

Investors benefit from annual tax-free allowances. Currently, any gains within this limit remain untaxed, allowing potential growth to remain untouched by tax. This contributes to the overall appeal of the product.

Despite tax advantages, stocks shares ISAs are subject to market risks. It’s essential for investors to stay informed about market trends. Monitoring these factors helps mitigate risks and identify opportunities.

Funds in these accounts can be accessed without penalties. However, withdrawal may affect your annual contribution limit. Balancing liquidity needs with investment strategy remains important.

Transferring existing ISAs into a stocks shares ISA is possible, which facilitates maintaining tax-free benefits. Proper management can leverage the tax shield over extended periods.

Benefits of Investing in a Stocks Shares ISA

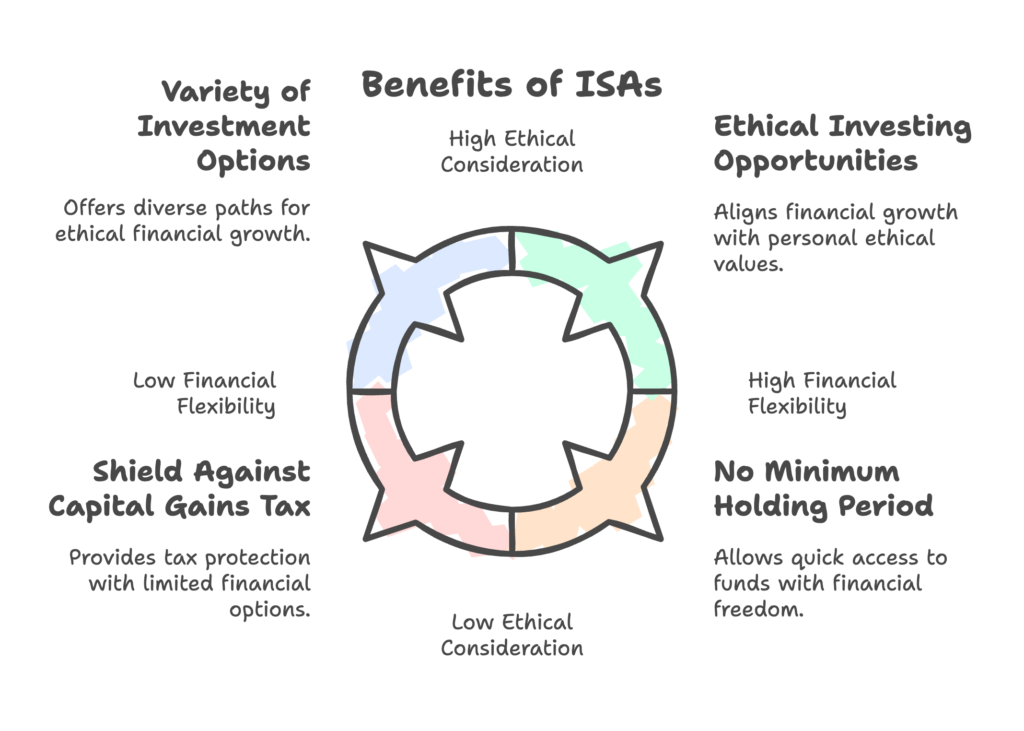

Investing in a stocks shares ISA offers several advantages. One of the most significant is tax efficiency. Profits and dividends within the ISA are exempt from capital gains tax and dividend tax. This means more of your money can stay invested and grow over time.

Another benefit is the ability to diversify your investment portfolio. You can choose a mix of individual stocks, funds, or ETFs. Diversification reduces risk by spreading investments across different assets.

Additionally, stocks shares ISAs offer flexibility. You can withdraw funds whenever needed without penalty. This liquidity is especially beneficial for unexpected expenses or financial opportunities.

Regular contributions can be tailored to your personal financial situation. You can make consistent monthly deposits or invest lump sums when you have extra cash. This flexibility helps in adapting to financial changes.

The compounding effect is another attractive feature. Reinvesting dividends can lead to exponential growth over time. The longer the investment period, the more pronounced the effect can be.

Investing in a stocks shares ISA can also support long-term financial goals, such as retirement planning. Because of its tax advantages, it complements other retirement savings vehicles.

Additional benefits include:

Understanding these benefits can help you make informed decisions about incorporating a stocks shares ISA into your financial strategy.

Tax Advantages of Stocks Shares ISAs

One of the primary appeals of a stocks shares ISA is its tax advantages. Investors in these accounts enjoy tax-free growth on their investments. This is due to the exemption from capital gains tax. When investments grow over time, they can do so without the burden of taxes cutting into profits.

Additionally, any dividends received within the ISA are free from dividend tax. This allows all earned income to be reinvested or withdrawn without tax deductions. Consequently, the potential for accumulating substantial savings improves.

Another important aspect is that withdrawals from a stocks shares ISA are not taxed. This is a notable contrast to other investment accounts where capital gains and dividends might be taxed upon removal.

Furthermore, there is no need to declare stocks shares ISA earnings on your annual tax return. This simplifies tax planning and reduces administrative burdens for individuals.

Ultimately, the tax-efficient nature of stocks shares ISAs makes them a compelling choice for both new and seasoned investors.

Potential for Higher Returns

A compelling aspect of investing in a stocks shares ISA is the potential for higher returns. Unlike cash ISAs, these accounts allow investments in the stock market. This can lead to greater potential returns. Stock market investments tend to outperform cash savings over longer periods.

Stocks shares ISAs expose your funds to market fluctuations, but with higher risk comes the possibility of higher reward. This opportunity appeals to those seeking to grow their wealth substantially over time.

Many people choose managed funds or ETFs within their ISA. These can provide access to a diversified portfolio of stocks. Diversification spreads risk and enhances potential returns.

Moreover, the power of compounding should not be underestimated. Regularly reinvested dividends and capital gains can significantly enhance growth over time. This is particularly true if one maintains a long-term investment perspective.

Finally, proactive management of your ISA can further increase returns. Regularly reviewing and adjusting your portfolio to adapt to market changes optimizes performance. By taking these steps, investors can maximize the growth of their stocks shares ISA.

Risks and Considerations

Investing in a stocks shares ISA involves various risks. Market volatility is a primary concern. Stock prices can fluctuate significantly, affecting portfolio value.

Economic downturns can also impact investment performance. Negative market conditions may lead to temporary losses. Investors should be prepared for such scenarios.

Understanding your risk tolerance is critical. Higher risk may mean higher rewards, but with potential losses. Each investor’s approach should reflect their comfort level.

Diversification within your ISA can mitigate some risks. Holding a mix of asset types reduces reliance on any single investment. This approach can help stabilize your portfolio.

Keeping informed about market trends and global events is essential. Staying updated can provide insights into potential risks and opportunities. Informed decisions are often more effective.

Understanding the Risks

Investing in a stocks shares ISA is not without risk. Market volatility can lead to rapid value changes. This characteristic requires careful consideration.

Global economic changes can also impact investments. Political or economic upheavals often lead to market instability. Monitoring these factors can be critical.

Currency fluctuations, especially for international stocks, may affect returns. Exchange rates can enhance or reduce profits. Understanding this impact is important.

Inflation poses another risk. It can erode real investment returns over time. Protecting against inflation may involve strategic choices.

Finally, there’s always the risk of company-specific issues. Individual stock performance can vary due to internal factors. Research and analysis are key to minimizing such risks.

Managing Your Investment Risk

Managing risk is an essential part of investing in a stocks shares ISA. Diversification is a proven strategy to spread risk. Allocating assets across sectors and geographies helps reduce exposure.

Setting clear investment goals is also crucial. A focused strategy aligns investments with personal objectives. This direction aids in maintaining composure during market swings.

Regular portfolio reviews ensure alignment with risk tolerance. Rebalancing may be necessary as circumstances change. Active management can lead to improved results.

Limiting exposure to high-risk stocks may also be wise. Balance higher-risk investments with more stable options. This approach smooths volatility.

Finally, consider professional advice to navigate complex markets. Experts can offer tailored guidance. This personalized support can enhance investment management and growth potential.

Opening and Managing a Stocks Shares ISA

Opening a stocks shares ISA is straightforward. Several platforms offer easy online setups. This convenience simplifies the process for new investors.

First, ensure eligibility criteria are met. Typically, you must be a UK resident over the age of 18. Confirm with your chosen provider for specific requirements.

Managing your ISA involves regular monitoring. Understanding the platform’s tools enhances management. Many offer real-time updates and insights to help track performance.

Consider your contribution strategy. Whether regular contributions or lump sums, plan according to your goals. Staying within the annual allowance is crucial.

Here’s a quick overview of managing a stocks shares ISA:

- Open an account with a provider

- Monitor investments regularly

- Stay within the annual allowance

- Adjust allocations as needed

- Use available tools for insights

Eligibility and How to Open an ISA

To open a stocks shares ISA, you must meet certain criteria. Primarily, you’ll need to be a resident of the UK. The minimum age requirement is often set at 18.

Choose a reputable provider to begin. Many offer online applications for convenience. Compare options based on fees, features, and support.

Ensure your identification and residency proof are ready. These documents are typically required for account setup. Accurate information ensures a smooth process.

Once your account is set up, you can begin funding. Start with a strategy that aligns with your financial goals. Regular contributions are beneficial for consistency.

Review the terms and conditions before finalizing. Understanding rules and restrictions helps avoid future issues. This step is vital for informed decision-making.

Transferring Existing ISAs

Transferring an existing ISA to a stocks shares ISA is possible. This process involves moving funds from one account to another. Ensure no loss of tax benefits during the transfer.

Check if your current provider supports transfers. Some may impose restrictions or fees. It’s essential to understand these details beforehand.

Begin by contacting the new ISA provider. They will guide you through the transfer process. Completing forms might be part of the procedure.

The transfer period can vary in duration. It may take weeks to complete, depending on providers. Patience is crucial during this time.

Avoid withdrawing funds personally to transfer. Doing so would result in losing your ISA’s tax-free benefits. Follow official transfer channels instead.

Halifax Stocks and Shares ISA: A Closer Look

The Halifax stocks and shares ISA is a popular choice for UK investors. It offers a range of features and benefits tailored for both beginners and seasoned investors. With Halifax, users can easily diversify their portfolios, managing investments with relative ease.

One key advantage is its user-friendly platform. Halifax provides an intuitive interface for tracking and managing investments. This feature ensures that even novices can confidently engage in the market.

Moreover, Halifax offers a broad selection of investment options. Clients can choose from various stocks, bonds, and funds. This flexibility caters to diverse risk appetites and financial goals.

The ISA also comes with tools and resources. These are designed to aid in making informed investment decisions. Tools such as insights and reports provide valuable market analysis.

Overall, Halifax combines accessibility with robust features. It’s designed to help investors maximize their stocks shares ISA potential while keeping investments secure.

Features and Benefits of Halifax ISA

The Halifax stocks and shares ISA stands out for its varied features. A prominent benefit is its wide selection of investment choices. Investors can access different asset classes, including equities, bonds, and funds.

Halifax also provides online tools and resources. These include market analysis and performance reports. Such resources help investors stay informed about market conditions.

Another benefit is the intuitive online platform Halifax offers. This platform allows effortless tracking and management of investments. Such ease of use is valuable for both novices and seasoned investors.

Investors gain flexibility in their investment approach. Halifax allows both lump sum and regular contributions. This flexibility is tailored to suit individual financial strategies.

Halifax’s reputation for reliable customer service is notable. They offer guidance and support throughout the investing journey. This support is crucial for both planning and ongoing management.

Fees and Charges with Halifax

Understanding fees and charges is vital when investing with Halifax. Transparency in costs is a key aspect of their offering. This clarity ensures investors can plan and manage their finances effectively.

Halifax implements an annual management fee. This fee covers the cost of maintaining the ISA. It may vary depending on the total investment amount.

Transaction fees might apply when buying or selling assets. These are relatively minimal but are important to factor in. Cost considerations affect overall investment returns.

Despite fees, Halifax aims to remain competitive. They focus on providing good value for the services offered. Investors can access detailed information about all charges through their platform.

Overall, awareness of associated costs aids in optimal portfolio management. Efficient management of these costs can maximize investment outcomes.

Managing Your Halifax ISA Online

Halifax provides a robust online platform for ISA management. This system is designed with user convenience in mind. It allows seamless tracking and adjustments to investments.

Investors have access to real-time data and insights. This access ensures informed decision-making and enhances financial planning. Users can monitor their portfolio performance continuously.

The platform facilitates easy fund transfers and transactions. It simplifies the process of buying and selling assets within the ISA. This simplicity is crucial for both efficiency and effectiveness.

Security is a top priority for online management with Halifax. The platform incorporates strong measures to protect investor data. Users can thus engage with peace of mind.

Additionally, Halifax offers mobile access to the platform. This option ensures investors can manage their ISAs anytime, anywhere. It provides the flexibility and convenience modern investors demand.

Conclusion and Next Steps

A stocks shares ISA is a powerful tool for UK investors. It offers the potential for tax-efficient growth and diversification. Engaging in this investment requires understanding its benefits and risks. A well-informed approach can significantly enhance financial outcomes.

Begin by reviewing your investment goals and strategies. Consider your risk tolerance and the assets you are comfortable with. Ongoing assessment ensures your ISA aligns with changing market conditions and personal objectives. This flexibility is key in dynamic financial landscapes.

Finally, stay informed and proactive. Regularly update your knowledge about market trends and regulatory changes. This vigilance can maximize your ISA’s potential.

Reviewing Your Investment Choices

It’s crucial to reassess your investment choices regularly. This ensures alignment with your financial goals.

Stay adaptable to market shifts and personal changes. Regular reviews can help optimize your investment strategy for better returns.

Seeking Professional Advice

Professional advice can greatly enhance your investing journey. Experts provide insights that help in making informed decisions.

Consider consulting with financial advisors for tailored investment strategies. This guidance supports optimal growth and risk management within your ISA.

Frequently Asked Questions

1. Can I access my money anytime in a Stocks and Shares ISA?

Yes, you can withdraw funds at any time without penalties. However, unless your ISA is flexible, withdrawn amounts won’t be added back to your annual allowance.

2. Do I have to pay tax on profits or dividends in a Stocks and Shares ISA?

No, all gains and dividends within a Stocks and Shares ISA are completely tax-free, and there’s no need to report them on your tax return.