In the digital world, a new trend is taking over. It’s called Non Fungible Tokens, or NFTs.

These unique digital assets are making waves in the realms of art, gaming, and beyond. They’re changing how we view ownership and value in the digital space.

But what exactly is an NFT? How does it work, and why is it so significant?

This guide aims to answer these questions. We’ll delve into the world of NFTs, exploring their origins, their uses, and their potential.

Whether you’re a digital artist, a crypto enthusiast, or just curious about this new trend, this guide is for you.

We’ll also look at the risks and rewards of NFT investment. And we’ll explore the future of this exciting technology.

So, let’s dive in and unravel the mystery of NFTs.

Understanding NFTs: The Basics

Non fungible tokens, or NFTs, are a type of digital asset. They exist on a blockchain, similar to cryptocurrencies like Bitcoin or Ethereum.

However, unlike these cryptocurrencies, each NFT is unique. This uniqueness is what makes them “non-fungible”.

In the world of NFTs, each token has a distinct value. This is unlike cryptocurrencies, where each unit is identical and can be exchanged on a one-for-one basis.

Here are some key features of NFTs:

- Each NFT is unique and cannot be replaced with something else.

- NFTs are stored on a blockchain, which verifies their authenticity and ownership.

- They can represent a wide range of tangible and intangible items, from digital art to virtual real estate.

What Makes a Token Non-Fungible?

The term “non-fungible” might sound complex, but it’s quite simple. It refers to something that is unique and can’t be replaced with something else.

For example, a painting is non-fungible. You can’t simply replace a Picasso with a Monet and call it even.

In the digital world, NFTs are the equivalent of these unique items. Each NFT has a digital signature that proves its authenticity and ownership.

The Technology Behind NFTs: Blockchain Explained

NFTs are built on blockchain technology. This is the same technology that underpins cryptocurrencies like Bitcoin and Ethereum.

But what is a blockchain? It’s a type of database that stores information in blocks. These blocks are then chained together.

When a new transaction occurs, it’s added to the participant’s list of transactions. This list is then checked against the entire blockchain to ensure its validity.

This technology ensures the security and transparency of NFT transactions. It verifies the authenticity and ownership of each NFT, making them secure and trustworthy digital assets.

The Evolution of NFTs

The concept of NFTs isn’t new. It has been around since the early days of blockchain technology.

The first significant use of NFTs came with the launch of CryptoKitties in 2017. This blockchain-based game allowed players to purchase, collect, breed, and sell virtual cats.

Each CryptoKitty was an NFT, with its own unique attributes and value. This game introduced the concept of NFTs to a wider audience and paved the way for their future development.

From CryptoKitties to Beeple’s $69 Million Artwork

The world of NFTs truly exploded in 2020 and 2021. This was largely due to the rise of NFT art.

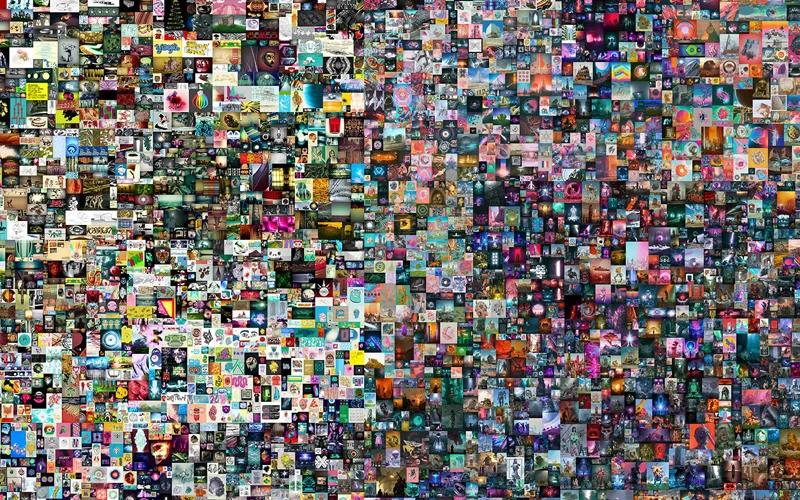

Digital artists began to use NFTs to sell their work, leading to some headline-grabbing sales. The most notable of these was the sale of Beeple’s artwork “Everydays: The First 5000 Days”.

This piece of digital art was sold as an NFT for a staggering $69 million at Christie’s auction house. This sale not only set a record for NFT sales but also positioned NFTs as a serious player in the art world.

The success of Beeple’s artwork has inspired other artists to explore NFTs. It has also sparked a broader conversation about the value of digital art and the future of the art market.

Beeple’s “Everydays: The First 5000 Days”

- The Artwork: A digital collage by the artist Mike Winkelmann, known as Beeple, created over 13 years (2007–2020). It’s composed of 5,000 daily images, each showcasing Beeple’s evolving style and commentary on society.

- Sales Statistics:

- Sold for $69.3 million at a Christie’s auction in March 2021.

- This sale marked the first time a purely digital artwork was sold by a major auction house.

- Cultural Significance:

- Positioned NFTs as a legitimate medium for fine art.

- Sparked widespread interest in digital ownership.

- Elevated Beeple to become one of the most financially successful artists alive.

- Image Description: A vibrant, intricate mosaic of small digital artworks, each with unique themes.

How Do NFTs Work?

NFTs operate on the principles of blockchain technology. They are created, or “minted”, on a blockchain network, most commonly Ethereum.

Each NFT contains a piece of digital content, such as an image, video, or audio file. This content is linked to a unique token on the blockchain.

The token acts as a digital certificate of authenticity. It verifies the ownership and originality of the linked content.

The key features of NFTs include:

- Uniqueness: Each NFT is one-of-a-kind and cannot be replicated.

- Ownership: The owner of an NFT has the rights to the linked content.

- Interoperability: NFTs can be bought, sold, and traded across different platforms.

- Indivisibility: Unlike cryptocurrencies, NFTs cannot be divided into smaller units.

Minting: Creating Your Own NFT

Creating an NFT, or “minting”, involves uploading a piece of digital content to a blockchain network. This process creates a unique token that is linked to the content.

The creator of the NFT can then sell or trade the token on an NFT marketplace. The ownership of the token, and the linked content, is transferred to the buyer.

To mint an NFT, you need some cryptocurrency. Usually, this is Ether (ETH) to pay for transaction fees on the blockchain.

Buying and Selling: NFT Marketplaces

NFT marketplaces are online platforms where NFTs can be bought, sold, and traded. These marketplaces operate on blockchain networks and use cryptocurrencies for transactions.

Some of the most popular NFT marketplaces include:

- OpenSea is the biggest NFT marketplace. It has many types of NFTs, like art, collectibles, and virtual real estate.

- Rarible: This marketplace allows users to create, buy, and sell NFTs. It also has a governance token, RARI, which gives users voting rights on the platform.

- Foundation: A platform that connects artists with collectors and curators. It has a curated selection of digital art NFTs.

When buying an NFT, it’s important to do your research. Check the authenticity of the NFT and the reputation of the seller. Also, consider the potential resale value of the NFT.

The World of NFTs: Use Cases and Examples

NFTs have a wide range of applications in the digital world. They are most commonly associated with digital art and collectibles.

However, their potential extends far beyond these areas. NFTs are also being used in gaming, virtual real estate, and even in the music industry.

NFTs have special features. They cannot be divided, and they can show who owns them. This makes NFTs great for digital assets.

Digital Art and Crypto Collectibles

Digital art is one of the most popular use cases for NFTs. Artists can mint their artwork as NFTs and sell them directly to collectors.

This process eliminates the need for intermediaries, allowing artists to retain more of their earnings. It also provides a new way for artists to monetize their work in the digital space.

Some notable examples of digital art NFTs include:

- Beeple’s “Everydays: The First 5000 Days”, which sold for $69 million at Christie’s auction house.

- CryptoPunks, a series of 10,000 unique pixel-art characters, which have sold for millions of dollars.

CryptoPunks

Image Description: Iconic 24×24-pixel art of characters with diverse appearances, often considered vintage digital collectibles.

The Collection: A series of 10,000 pixel-art characters created by Larva Labs in 2017. Each CryptoPunk is algorithmically generated, making them unique in attributes (e.g., hairstyles, hats, glasses, etc.).

Sales Statistics:

Some individual CryptoPunks have sold for millions of dollars.

Example: CryptoPunk #5822 sold for $23.7 million in 2022, making it one of the most expensive NFTs.

Cultural Significance:

Pioneered the NFT movement, serving as one of the first collections to popularize the concept of provable ownership.

Became status symbols among crypto enthusiasts and celebrities.

Inspired countless generative art projects and paved the way for NFT collections like Bored Ape Yacht Club.

Crypto collectibles are another popular type of NFT. These are unique digital assets that can be collected and traded. They often take the form of digital pets or characters.

Gaming, Virtual Real Estate, and Beyond

NFTs are revolutionizing the gaming industry. They allow players to truly own their in-game assets, such as characters, items, and land.

These assets can be bought, sold, and traded on NFT marketplaces. This creates a new economy within the game, where players can earn real-world value from their in-game activities.

Some popular NFT-based games include:

- CryptoKitties, a game where players can collect, breed, and trade unique virtual cats.

- Decentraland, a virtual world where players can buy, sell, and build on virtual land.

Virtual real estate is another emerging use case for NFTs. Platforms like Decentraland and Cryptovoxels allow users to buy, sell, and trade virtual land as NFTs.

These virtual spaces can be used to host digital events, display digital art, or build virtual businesses. This opens up new possibilities for digital experiences and interactions.

Investing in NFTs: Opportunities and Risks

Investing in NFTs can be a lucrative venture. The market has seen some astonishing sales, with certain pieces of digital art selling for millions of dollars.

However, like any investment, it comes with its own set of risks. The NFT market is highly volatile and prices can fluctuate wildly.

Moreover, the market is still relatively new and unregulated, which can lead to potential scams and fraud.

NFT Vs Traditional Assets Comparison

| Feature | NFTs | Traditional Paintings | Stocks | Cryptocurrencies |

|---|---|---|---|---|

| Ownership Verification | Blockchain-based, easily verifiable | Physical authentication required | Registered ownership via brokerage | Blockchain-based, easily verifiable |

| Physical Presence | No physical presence, purely digital | Tangible asset, physical presence | No physical presence, intangible | No physical presence, purely digital |

| Market Liquidity | High, with 24/7 global marketplaces | Low, reliant on art auctions and galleries | High liquidity in financial markets | High liquidity in crypto exchanges |

| Uniqueness | Each NFT is unique and non-replicable | Unique but can have forgeries | Not unique, multiple shares available | Fungible, each unit is identical |

| Divisibility | Indivisible (cannot be split like crypto) | Indivisible (cannot split ownership easily) | Divisible (can buy fractions of shares) | Divisible (e.g., up to 8 decimals for Bitcoin) |

| Investment Risks | High volatility, speculative market | Valuation depends on collector interest | Moderate risk, tied to company performance | High volatility, speculative market |

| Environmental Impact | Significant, depending on blockchain used | Minimal, associated with creation and storage | Minimal, related to company operations | Significant, depends on blockchain used |

NFT Investment Strategies

When investing in NFTs, it’s important to have a clear strategy. Some investors focus on buying early and selling high, similar to traditional art investing.

Others may choose to invest in NFTs related to a specific niche or industry, such as gaming or music.

It’s also crucial to do thorough research before investing. This means knowing the artist or project behind the NFT. It also involves understanding how rare the NFT is and its chance to increase in value later.

The Risks of NFT Investing

Investing in NFTs is not without risks. The market is highly speculative and prices can drop as quickly as they rise.

There’s also the risk of buying counterfeit NFTs or falling victim to scams. It’s important to verify the authenticity of an NFT before purchasing.

Furthermore, the legal framework around NFTs is still evolving. Issues around copyright and ownership can lead to potential legal disputes. As with any investment, it’s important to understand the risks and invest responsibly.

The Future of NFTs

The future of NFTs looks promising. As more industries recognize their potential, we can expect to see a wider adoption of this technology.

NFTs have the potential to revolutionize various sectors, from art and music to real estate and gaming. They can provide a new way for creators to monetize their work and for consumers to own digital assets.

The future of NFTs will depend on how well the market handles its current problems. These include environmental concerns and issues with copyright and ownership.

Innovations and Trends in the NFT Space

Innovation is a key driver in the NFT space. We are seeing new uses for NFTs. These include virtual fashion, digital real estate, decentralized finance, and supply chain management.

There’s also a growing trend towards fractional ownership of NFTs. This allows multiple people to own a share of a single NFT, making high-value NFTs more accessible.

Another trend to watch is the integration of NFTs with augmented reality (AR) and virtual reality (VR). This could enhance the user experience and open up new possibilities for digital ownership.

NFTs and Their Role in the Digital Economy

NFTs are playing an increasingly important role in the digital economy. They offer a way to show ownership of digital assets. These can include digital art, music, virtual real estate, and digital identities.

NFTs also offer new opportunities for creators to monetize their work. By tokenizing their work, creators can sell it directly to consumers, bypassing traditional intermediaries.

Moreover, NFTs can facilitate the creation of new business models. For example, they can be used in loyalty programs, where customers earn NFTs that can be redeemed for goods or services.

Conclusion: The Impact of NFTs on Digital Ownership

NFTs are reshaping the concept of digital ownership. They provide a way to prove and transfer ownership of unique digital assets, opening up new possibilities for creators and consumers alike.

As we move further into the digital age, the role of NFTs is likely to grow. They offer a solution to the challenge of proving ownership in the digital world, and their potential applications are vast. From art and music to real estate and identity, NFTs are set to play a key role in the digital economy.

FAQs

What is an NFT?

An NFT, or Non-Fungible Token, is a special digital asset. It is stored on a blockchain. NFTs show ownership of items like art, music, virtual real estate, or collectibles.

How do NFTs work?

NFTs are created, or “minted,” on blockchain networks like Ethereum. Each NFT has a unique token that verifies its authenticity and ownership.

What makes an NFT non-fungible?

Non-fungibility means that each NFT is one of a kind. It cannot be replaced with something else. This is different from cryptocurrencies or fiat money, which are fungible.

What can be turned into an NFT?

You can create NFTs from various things. These include:

Digital art

Music

Videos

Virtual real estate

Game items

Domain names

Tweets

Physical assets

How do I buy an NFT?

NFTs can be purchased on marketplaces like OpenSea, Rarible, and Foundation using cryptocurrencies, usually Ethereum (ETH).

How do I sell an NFT?

To sell an NFT, you can list it on an NFT marketplace. The platform will guide you through setting a price and transferring the token to the buyer once it’s sold.

What is minting an NFT?

Minting an NFT is the process of creating a unique token on a blockchain that is tied to a specific piece of digital content.

Do I own the copyright to an NFT I buy?

When you buy an NFT, you own the token. However, this does not mean you own the copyright or reproduction rights. You only get those rights if the creator clearly states so.

What are the risks of investing in NFTs?

Risks include market volatility, lack of regulation, potential scams, and environmental concerns associated with blockchain technology.

How are NFTs different from cryptocurrencies?

Cryptocurrencies like Bitcoin and Ethereum are fungible, meaning each unit is the same. In contrast, NFTs are non-fungible, which means each token is unique.

Are NFTs a good investment?

NFTs can be lucrative, but they are highly speculative. Their value depends on demand, rarity, and market trends.

What are some popular NFT projects?

Examples include CryptoPunks, Bored Ape Yacht Club, Beeple’s digital art, and virtual land in Decentraland.

What is an NFT marketplace?

An NFT marketplace is a website where people buy, sell, and trade NFTs. Examples include OpenSea, Rarible, and SuperRare.

How can artists benefit from NFTs?

Artists can monetize their work directly, retain royalties through smart contracts, and eliminate the need for intermediaries.

What is the environmental impact of NFTs?

Creating and trading NFTs use a lot of energy. This is because they run on blockchain networks. Proof-of-work blockchains, like Ethereum, use the most energy.

Can NFTs lose their value?

Yes, NFTs are highly speculative and can lose value if demand decreases or the market declines.

What is a gas fee in NFTs?

Gas fees are transaction costs required to mint, buy, or sell NFTs on blockchain networks.

Are NFTs regulated?

The NFT market is largely unregulated, which raises concerns about fraud, scams, and consumer protection.

What is fractional ownership of an NFT?

Fractional ownership allows multiple people to own shares of a single NFT, making high-value NFTs more accessible.

What is the future of NFTs?

NFTs are expected to become more popular in many areas. These include gaming, real estate, art, and decentralized finance (DeFi). New uses for NFTs are appearing all the time.