The Weighted Average Cost of Capital (WACC) is a financial measure. It shows the average cost a company pays for its capital. This capital includes both equity (stock) and debt (loans or bonds). Think of it as the “blended rate” a company must pay to finance its operations or new projects.

Breaking It Down:

- Capital Sources:

- Equity: Money from investors who own shares in the company.

- Debt: Loans or bonds the company owes to creditors.

- Weighted Average:

- Since companies usually use both equity and debt, WACC finds the average cost of these two sources. It does this based on their proportions.

- Why It Matters:

- WACC helps businesses figure out if a project or investment is worth pursuing. If the project’s return exceeds the WACC, it’s a good investment. If not, it might not be worth it.

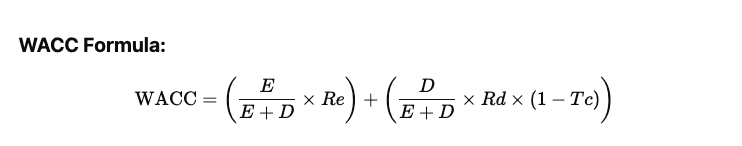

Where:

- E: Market value of equity (shares)

- D: Market value of debt

- Re: Cost of equity (return expected by shareholders)

- Rd: Cost of debt (interest rate on loans)

- Tc: Corporate tax rate (because interest on debt is tax-deductible)

How to Calculate WACC (Step-by-Step):

- Find the Cost of Equity (Re):

- Use the Capital Asset Pricing Model (CAPM): Re=Rf+β×(Rm−Rf)Re = Rf + \beta \times (Rm – Rf)Re=Rf+β×(Rm−Rf)

- Rf: Risk-free rate (e.g., government bond yield)

- β (Beta): Measure of stock’s volatility compared to the market

- Rm: Expected market return

- Use the Capital Asset Pricing Model (CAPM): Re=Rf+β×(Rm−Rf)Re = Rf + \beta \times (Rm – Rf)Re=Rf+β×(Rm−Rf)

- Determine the Cost of Debt (Rd):

- Look at the interest rate on the company’s loans or bonds.

- Calculate Proportions of Debt and Equity:

- Find the total market value of equity (E) and debt (D).

- Calculate the proportions:

- EE+D\frac{E}{E+D}E+DE for equity

- DE+D\frac{D}{E+D}E+DD for debt

- Apply the Tax Rate (Tc):

- Interest on debt reduces taxable income, so include the tax benefit.

- Plug Everything into the Formula:

- Combine the weighted cost of equity and debt to get WACC.

Why is WACC Important?

- Investment Decisions:

- WACC serves as the benchmark for investment returns. Projects with returns above the WACC create value; those below it destroy value.

- Valuation:

- It’s used in Discounted Cash Flow (DCF) analysis to value companies or projects.

- Funding Strategy:

- Helps companies decide on the right mix of equity and debt to minimize costs.

Example of WACC Calculation:

Scenario:

Market value of equity (E): $2 million

Market value of debt (D): $1 million

Cost of equity (Re): 10%

Cost of debt (Rd): 5%

Tax rate (Tc): 25%

Step 1: Calculate Weights

E / (E + D) = 2,000,000 / (2,000,000 + 1,000,000) = 0.67

D / (E + D) = 1,000,000 / (2,000,000 + 1,000,000) = 0.33

Step 2: Apply Formula

WACC = (0.67 × 10%) + (0.33 × 5% × (1 - 0.25))

\text{WACC} = (0.67 × 10%) + (0.33 × 5% × (1 - 0.25))

WACC = 6.7% + 1.24% = 7.94%

Result:

The company’s WACC is 7.94%, meaning any project or investment needs to generate at least this return to be worthwhile.

Key Takeaways:

- Lower WACC = Cheaper Capital:

A lower WACC means it’s easier for the company to fund operations or new projects profitably. - Higher Debt Can Reduce WACC (Up to a Point):

Since debt is cheaper due to tax benefits, it can reduce WACC—but too much debt increases risk. - Industry and Market Impact:

Companies in stable industries, like utilities, usually have a lower WACC. This is because they have predictable returns. In contrast, high-risk industries, such as tech startups, tend to have a higher WACC.

Conclusion

The Weighted Average Cost of Capital (WACC) is an important tool for businesses and investors. It helps them evaluate the cost of funding and the returns on investments. By understanding WACC, companies can make better choices about financing. Investors can also evaluate how appealing a company’s projects or stock are.

Frequently Asked Questions (FAQ)

1. What is Weighted Average Cost of Capital (WACC)?

Weighted Average Cost of Capital (WACC) is the average rate a company is expected to pay to finance its assets, considering both equity and debt. It serves as a benchmark for evaluating investment opportunities.

2. Why is Weighted Average Cost of Capital (WACC) important?

WACC is crucial because it helps determine whether a project or investment will generate enough returns to cover the company’s financing costs. If the return exceeds the WACC, the investment adds value.

3. How is WACC calculated?

WACC is calculated by taking the cost of equity and the cost of debt, weighting them based on their proportion in the company’s capital structure, and adjusting for taxes on debt.

4. Can the Weighted Average Cost of Capital (WACC) change over time?

Yes, WACC can change as market conditions, interest rates, tax rates, and the company’s debt-to-equity ratio evolve. Companies should recalculate WACC regularly to maintain accurate financial analysis.

5. What is a good WACC value for a company?

There’s no universal “good” WACC—it varies by industry. Generally, a lower WACC means cheaper capital and greater investment potential, especially in stable, low-risk sectors.