Are you searching for a way to measure how much income your stocks really earn you over time? If so, Yield on Cost (YOC) is a fantastic metric to keep in your toolbox. Below, we’ll walk through exactly what YOC is, why it matters, and some inspiring real-world examples to show you how it works. By the end, you’ll see why so many long-term investors get excited about YOC and how it can keep you motivated on your dividend-investing journey.

What Is Yield on Cost (YOC)?

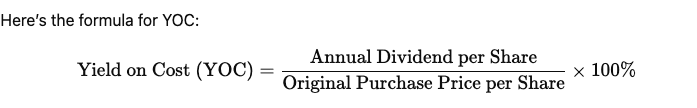

In the simplest terms, Yield on Cost (YOC) shows you how much dividend income you receive each year relative to the price you originally paid for the stock. It’s different from the current dividend yield, which looks at the stock’s price right now. YOC, on the other hand, focuses on your own initial purchase price—the amount you paid when you first bought the shares.

Think of YOC like a personal report card. It helps you see how far you’ve come since the day you decided to invest and monitor your Yield on Cost over time to gauge your performance.

Why Does Yield on Cost Matter?

- Keeps You Motivated

Watching your YOC grow over time can be thrilling. As a company raises its dividend, you’ll see your personal yield shoot up—giving you a reason to celebrate every new dividend increase. - Rewards Long-Term Thinking

If you stick with dividend-paying stocks for the long run, your YOC often goes up. This growth reflects how your initial investment is generating more income each year. - Personalized to You

Unlike the current yield, which is based on today’s stock price, YOC is unique to your own investment. Two people who buy the same stock at different times (and prices) will have different YOCs—even if they both hold the same number of shares.

Real Example #1: Seeing Dividend Growth in Action

Imagine you purchase 100 shares of Company A at $40 per share (so you invest $4,000 total). At that time, Company A’s annual dividend is $1.20 per share. Your initial YOC is:

$1.20÷$40=3%

Now, fast-forward five years. The company has done well and increases its annual dividend to $2.00 per share. Your YOC is calculated based on the original $40 price, not the new market price. So it becomes:$2.00÷$40=5%

Even if the stock’s market price is now $60, you get to enjoy a 5% yield on your $40 cost. A new investor paying $60 per share gets a current yield of about 3.3%. That’s the magic of buying early and holding on—and seeing the advantage of Yield on Cost for the long term.

Real Example #2: Power of Reinvesting Dividends

Let’s say you buy Company B at $20 per share, and it pays a dividend of $0.80 a year at first (a 4% yield). Over time, the company grows and raises its dividend to $1.00 per share. Meanwhile, you decide to reinvest all your dividends, buying more shares whenever you’re paid.

Thanks to dividend increases and reinvestment:

- Your YOC jumps to $1.00 ÷ $20 = 5%.

- You own more shares than you started with (because of reinvestment).

- Your total dividend checks are bigger each year, even if the stock’s price goes up, down, or sideways.

This is how compounding works: it rewards patience and consistency—and monitoring your Yield on Cost can show this growth clearly.

YOC vs. Current Dividend Yield

- Yield on Cost (YOC) looks at your original purchase price.

- Current Dividend Yield is based on the stock’s current market price.

If the stock price rises a lot while dividends grow more slowly, the current yield might not seem that high. But if you locked in a low purchase price years ago, your YOC could be significantly higher, giving you a sense of pride and accomplishment in your investing strategy.

Points to Remember

- Use YOC as a Motivation Tool—Not a Buying Guide

YOC is great for seeing how far you’ve come, but it doesn’t necessarily tell you if a stock is a good buy today. For new purchases, consider the current dividend yield and the company’s future growth potential. - Dividends Can Be Cut

Dividends aren’t guaranteed forever. If a company’s financial health weakens, it might reduce or eliminate its dividend. Keep an eye on company fundamentals and only hold stocks you believe can keep paying (and hopefully raising) those dividends. - Mind the Taxes

Dividends often come with tax implications. Plus, reinvesting dividends can affect your cost basis. Make sure you’re aware of how taxes might impact your returns or speak with a tax professional.

Conclusion: Celebrate Your Progress

Yield on Cost (YOC) is like a personal cheerleader for dividend investors. Every time the company raises its dividend, you get to watch your YOC climb—and that feels great! It’s a powerful reminder of how patience, good research, and solid companies can reward you over the long haul.

If you’re passionate about dividend growth investing, start tracking your alongside your portfolio’s current yield. You may discover that celebrating your YOC achievements keeps you more focused and excited about your long-term financial goals. Here’s to growing dividends and a brighter investment future!

FAQs on Yield on Cost (YOC)

Q1: Is YOC useful for making new investment decisions?

A: Not really. YOC shows how well past investments have done, but it doesn’t help decide if a stock is a good buy today. Use current yield and future growth outlook instead.

Q2: How is YOC different from current dividend yield?

A: YOC is based on your original buy price. Current yield uses today’s market price. Over time, YOC can grow higher if dividends increase.