Yield to Maturity (YTM) helps you find out how much you will earn on a bond if you keep it until it matures. YTM considers the interest payments you receive over time. It also looks at any gain or loss if you bought the bond for a price different from its face value.

Why Is YTM Important?

- Clear Profit Estimate

- YTM gives you a reliable idea of how much you could earn from your investment through Yield to Maturity.

- Comparison Tool

- You can compare different bonds using YTM to see which one might offer a better return based on Yield to Maturity.

- Risk Management

- By knowing potential returns with Yield to Maturity, you can balance risk and reward in your investment plan.

- Future Planning

- Investors can use YTM to decide if a bond fits their short-term or long-term financial goals.

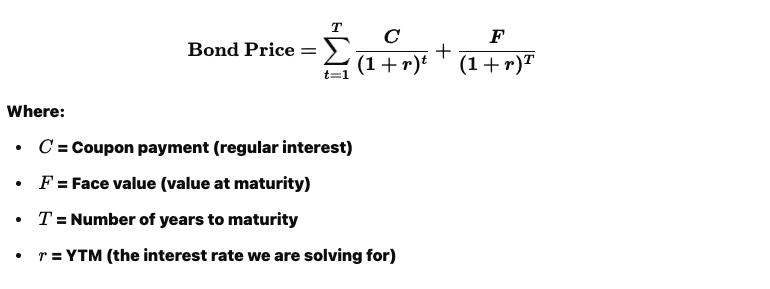

How to Calculate YTM

Calculating YTM can be tricky. It involves finding the rate that makes the present value of future bond payments equal to the price you paid for the bond. However, many financial calculators or online tools can do the math for you, helping you understand Yield to Maturity.

Simple Example of YTM

Imagine you buy a bond for $900 that has a $1,000 face value and pays $50 each year in interest. If this bond matures in 5 years, YTM shows the annual return you earn. It considers the yearly interest of $50. You will also receive $1,000 at the end of 5 years. This amount is $100 more than what you paid at first, showcasing Yield to Maturity.

Factors Affecting YTM

- Bond Price

- If the price you pay for the bond is lower, the YTM tends to be higher (and vice versa), affecting Yield to Maturity.

- Interest Rates

- If market interest rates go up, bond prices usually go down, which can affect YTM and the Yield to Maturity.

- Credit Quality

- Bonds from companies or governments with high credit ratings usually have lower YTMs. This is because they are considered safer investments that can influence Yield to Maturity.

- Time to Maturity

- The longer until the bond matures, the more uncertainty there is about future interest rates and economic conditions, impacting Yield to Maturity.

Tips for Investors

- Use Tools and Calculators: Online tools make it easy to compare YTMs across different bonds, facilitating the calculation of YTM

- Check Credit Ratings: A high YTM can be attractive, but be aware of any credit risks that might affect the Yield to Maturity.

- Diversify Your Portfolio: Don’t put all your money in one type of bond or investment.

- Review Market Conditions: Keep an eye on interest rates, inflation, and economic news that can influence Yield to Maturity.

Final Thoughts

YTM is a helpful measure for anyone looking to invest in bonds. It shows how much money you can make from a bond if you keep it until it matures. This Yield to Maturity makes it easier to compare different bond choices. By understanding YTM, you can make smarter investment choices and manage risks in your portfolio.